My Dividend Portfolio

This page is a snapshot of my real dividend portfolio, including core holdings, and my bigger vision for building lasting passive income. Whether you’re just starting out or already a dividend enthusiast, I hope this gives you insight and inspiration for your own journey.

My Strategy: Grow Passive Income Over Time

My main objective is to build a portfolio that generates enough passive income to live off of. This would allow me to retire early and, just as importantly, leave the portfolio intact so that it can continue to grow and become a source of generational wealth for my kids.

This goal influences every investment decision I make.

Current Portfolio Stats

Here’s how my dividend portfolio measures up:

2.65% forward dividend yield

3.55% yield on cost (the average income rate on my initial investment, showing dividend growth in action)

9.5% average annual dividend growth rate

What’s Inside My Portfolio

I focus on two main groups:

Dividend Growth Stocks:

Reliable businesses with a proven record of increasing payouts and capital appreciation. Dividend Growth Stocks (DGI) often have lower starting dividend yields, but high annual growth rates.High Yield, High Quality Stocks:

Companies offering generous current income, but only if their fundamentals and balance sheets pass the test. High Yielders may have slower growth, but their dividends can be reinvested to compound wealth steadily.

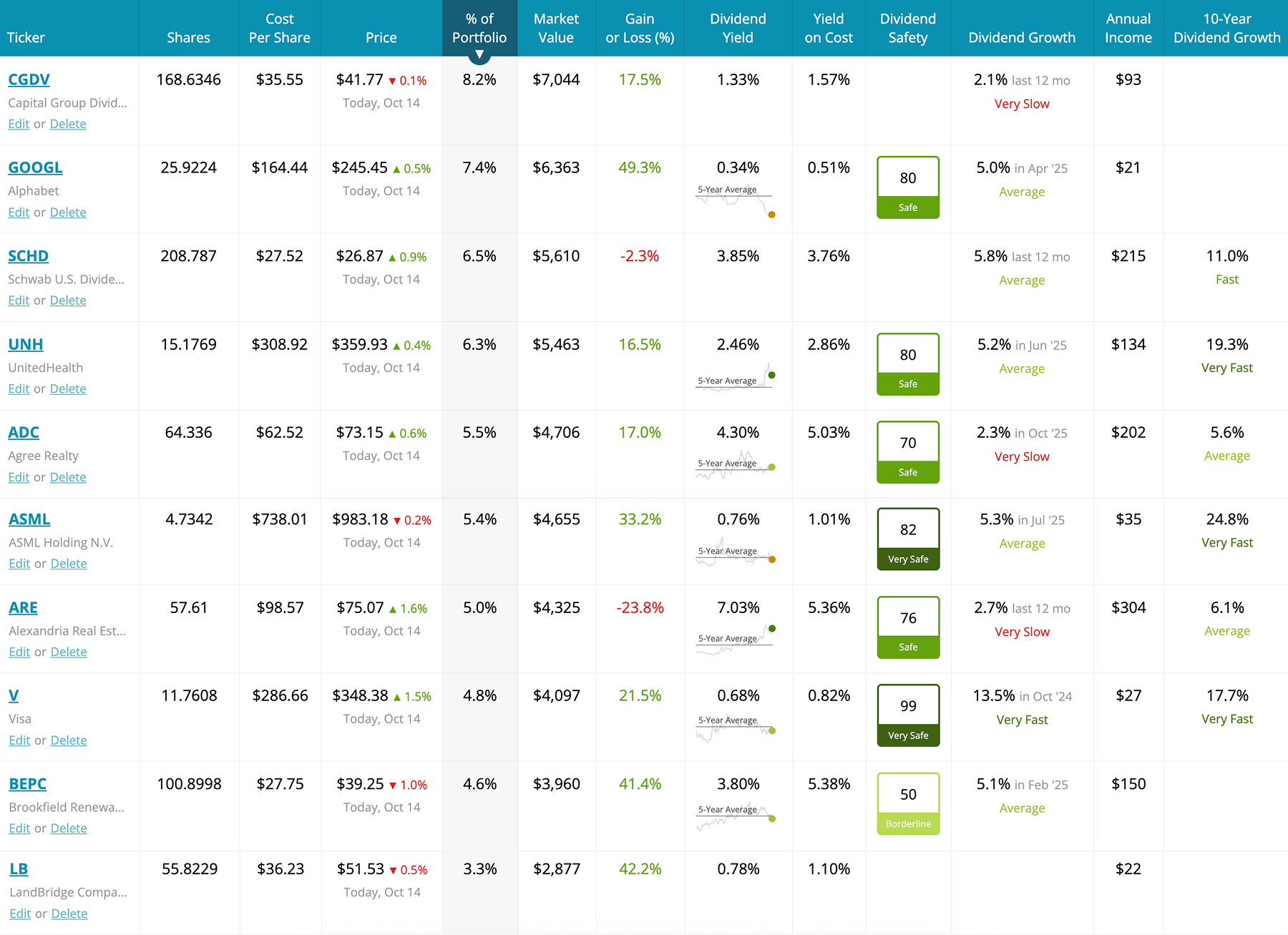

Top 10 Dividend Stocks in My Portfolio

Here’s a rundown of my top dividend payers - the companies and funds I count on most for future income. I consider each of these a business that I own a small piece of and “building blocks” for my family’s financial freedom.

CGDV (Capital Group Dividend Value ETF): An actively managed ETF by Capital Group, it’s like having a team of experts hand-picking top U.S. dividend growth companies for me.

GOOGL (Alphabet): The company powering most internet searches and YouTube binges - finally in the dividend game.

SCHD (Schwab U.S. Dividend Equity ETF): One of my all-time favorites, focusing on big-name American companies with dependable, growing dividends.

UNH (UnitedHealth Group): The backbone of American health insurance; their steady performance means reliable income year after year.

ADC (Agree Realty): The buildings behind some of your favorite stores—think Walmart, Target, and Home Depot. As a leading real estate investment trust (REIT), ADC rents these properties to big-name retailers, collecting steady rent funding reliable dividends.

ASML (ASML Holding): Behind most of your favorite gadgets, ASML builds the machines that make the world’s most advanced computer chips - the foundation behind the AI revolution.

ARE (Alexandria Real Estate Equities): A real estate company building campus clusters near top universities, bringing together leading healthcare companies like Eli Lilly, Moderna, and Bristol Myers Squibb to accelerate life science and innovation.

V (Visa): The backbone of global payments, acting as a worldwide tollbooth for money movement. Every time you swipe, tap, or shop online, Visa collects a fee - facilitating trillions in transactions each year.

BEPC (Brookfield Renewable): A leader in renewable energy, they invests in the infrastructure behind daily life - powering the global buildout of data centers that keep our digital world running.

LB (Landbridge): Owns prime land in Texas, earning income by renting to energy companies and managing a growing water business that helps power the oil and gas industry.

Stay Tuned!

I’ll keep posting updates to show exactly how my portfolio and income grow over time. Whether you’re on a similar path or just exploring the idea, I hope my story helps you shape your own plan for financial independence.

Join me as we build wealth with dividends, one day at a time!

If this sounds like something you're into, subscribe so we can be friends!

Keep Walking,

Jeremy ✌️

Disclaimer

This site is for informational and educational purposes only. I am not a financial advisor, broker, or tax professional. The information provided reflects my personal opinions and experiences as an individual investor and may not be accurate or current. All investment strategies and investments involve risk of loss. Any ideas presented may not be suitable for all investors and may not take into account your specific investment objectives, financial situation, or needs. Past performance is not indicative of future results. Always conduct your own due diligence and consult with qualified financial professionals before making any investment decisions.