From Side Hustler to Investor

The path to financial freedom

Day 160 | $22,000

This is not financial advice! Do your own research or consult a financial advisor before making any investment.

It’s been 160 days since I started sharing my journey online. This is my first post of 2025 and the portfolio has come a long way. While I didn’t post anything in January, my portfolio has been busy and is sitting just over $22,000.

Today, I want to share a little about my investing journey: How I started and where I am heading!

How I Started…

I’ve always been a bit of a dreamer. And while I love my full-time design job, I’ve constantly been on the hunt for financial freedom—a way to escape the paycheck-to-paycheck grind and take control of my time.

Over the years, I’ve tried just about every side hustle you can think of. From freelance design work to running an Etsy store with my wife, I poured countless hours into these ventures. But no matter how hard I worked, none of them seemed to truly move the needle.

Then came the pandemic. With remote work becoming the norm, I decided to refocus my energy on leveling up my career. In 2022, I put my side hustles on pause, and transitioned to a corporate design gig.

But as I started digging into my shiny new retirement plan, reality hit me like a ton of bricks: I was way behind on my financial independence goals. My 401k was going to need some help!

Enter Investing

That’s when I discovered investing—and everything started to click. Suddenly, I saw how passive income and long-term wealth could work together to unlock the door to financial freedom.

This realization led me to embrace dividend investing—a strategy that offers steady income and the magic of compounding wealth over time. It’s become the cornerstone of my financial plan and completely transformed how I think about money.

Where I Am Heading…

My goal is straightforward: build a portfolio, become financially independent in the next 10–15 years, and live off the dividend income it generates. By leaving the investment untouched, it will continue growing even when I start spending those dividend paychecks.

The best part? This plan doesn’t just benefit me—it sets up generational wealth for my kids. One day, when the time is right, I’ll pass down my portfolio so they can reap the rewards too (and hopefully not blow it all on Roblox!)

My 3-Part Dividend Portfolio

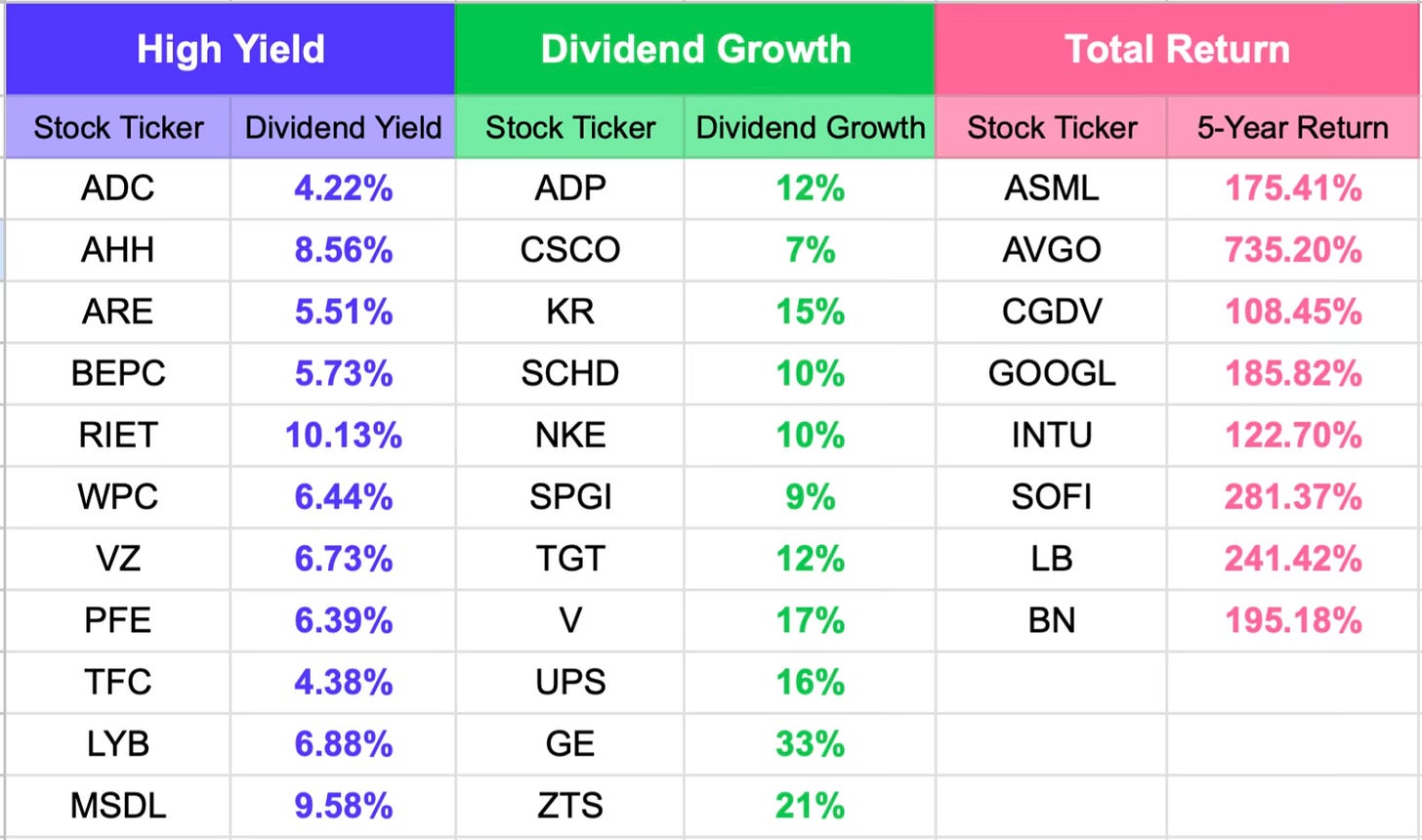

To achieve this goal, I’ve built a portfolio of 30 dividend-paying stocks divided into three categories:

High Yield: Stocks with above-average dividend payouts and stable growth—because who doesn’t love getting paid just for holding shares?

Dividend Growth: Companies that consistently increase their dividends over time—these are like annual pay raises for doing absolutely nothing.

All-Round Return: Balanced stocks that combine dividend income with long-term capital appreciation—my “best of both worlds” picks.

If you’ve been around since I started, you’ll see a majority of companies that you are familiar with, but you’ll also see a few additions as I’ve transitioned into this strategy, mainly in the high yield category.

The reality is that my original focus on pure dividend growth wasn’t going to give me enough passive income to live off of in my timeframe. I now have a more balanced approach between income and growth.

Moving Forward with 2 Portfolios

160 days ago I started a brand new portfolio from scratch. Since then, we’ve went from $0 to $22,000. I did this so anyone could follow along. It seems most YouTubers and bloggers start sharing once they’ve hit a massive portfolio milestone. I want to show you the highs and lows during the whole process.

While I still plan to focus on growing the “Walk to Wealth” portfolio from scratch, I want to bring in the portfolio I started back in 2023 (which I haven’t shared with you yet).

I spent time in January aligning the mission between the 2 portfolios and they now have the same mix of stocks. Here’s how I plan to use each one:

Fidelity—I’ve automated the “Walk to Wealth” portfolio in my Fidelity account (the one I’ve been building here from scratch) to spread weekly contributions over the 30 stocks based on a percentage weight.

Ally—The original portfolio (started in 2023) in my Ally Investing account will hold the same stocks but I’ll add shares only when I see a buying opportunity. In other words, when 1 of the 30 stocks dips to a value that I just can’t pass up!

The two portfolios combined are just over $57,000:

Fidelity—$22,000

Ally—$35,000

The Portfolio Breakdown

Now, let’s look at the companies that make up the portfolio.

High Yield

Agree Realty (ADC) - 4.22% dividend yield

Armada Hoffler Properties (AHH) - 8.56% dividend yield

Alexandria Real Estate (ARE) - 5.51% dividend yield

Brookfield Renewable Corporation (BEPC) - 5.73% dividend yield

RIET ETF (RIET) - 10.13% dividend yield

W. P. Carey Inc. (WPC) - 6.44%

Verizon Communications (VZ) - 6.73 dividend yield

Pfizer Inc. (PFE) - 6.39% dividend yield

Truist Financial (TFC) - 4.38% dividend yield

LyondellBasell Industries N.V. (LYB) - 6.88% dividend yield

Morgan Stanley Direct Lending (MSDL) - 9.58% dividend yield

Dividend Growth

Automatic Data Processing (ADP) - 12% dividend growth

Cisco Systems (CSCO) - 7% dividend growth

The Kroger Co. (KR) - 15% dividend growth

Schwab US Dividend Equity ETF (SCHD) - 10% dividend growth

Nike, Inc. (NKE) - 10% dividend growth

S&P Global (SPGI) - 9% dividend growth

Target Corporation (TGT) - 12% dividend growth

Visa Inc. (V) - 17% dividend growth

United Parcel Service (UPS) - 16% dividend growth

General Electric (GE) - 33% dividend growth

Zoetis Inc. (ZTS) - 21% dividend growth

All-Round Return

ASML (ASML) - 175% 5-year return

AVGO (AVGO) - 735% 5-year return

Capital Group Dividend Value ETF (CGDV) = 108% 2-year return

Alphabet (GOOGL) - 185% 5-year return

Intuit (INTU) - 122% 5-year return

SoFi Technologies (SOFI) - 281% - 5-year return *non-dividend payer

LandBridge Company LLC (LB) - 241% 1-year return

Brookfield Corporation (BN) - 195% 5-year return

You can read more about each stock here:

This journey is just getting started!

My goal remains steadfast: to build a portfolio that allows me to live off dividend income within 10–15 years while continuing to grow wealth for future generations.

Along the way, I’ll share every step—the wins, the lessons, and even the setbacks—because this isn’t just about me. It’s about showing others that financial freedom is possible, no matter where you start.

If you’re reading this and wondering if you can make the leap from side hustler to investor, let me tell you: You absolutely can.

It takes time, discipline, and a willingness to learn—but the rewards are worth it. So here’s to 2025 and beyond—a year of growth, opportunity, and taking one step closer to financial independence.

Until next time, keep walking!

Jeremy ✌️