The Wealth Snowball: Building a Passive Income Stream!

Following Kevin Simpson's Investment Strategy

Ever Feel Like You’re Walking at a Snail’s Pace?

What if there was a path that not only took you where you want to go but also picked up speed along the way? That’s the idea behind Kevin Simpson’s Book, "Walk Toward Wealth." It’s a smart and simple approach that combines the steady power of dividend investing with a clever trick to boost your income: covered calls.

Side Note: I had no clue this book existed when I named my blog A Walk to Wealth, but I’ll take that as a sign!

This post will break down how Simpson's method works, showing you how these two ideas can come together to create a powerful passive income snowball. And stick around, because at the end, I'll give you a sneak peek at my new project, Wealth Walk, where I’m putting this exact strategy into action with six different dividend funds.

The Foundation: Your Dividend Engine

The heart of the "Walk Toward Wealth" strategy is a solid portfolio of dividend-paying stocks. But we’re not just talking about any old stocks. The key is to find great companies that consistently increase their dividends year after year. Think of it like a paycheck that gets a raise without you having to ask.

The magic here is in the compounding. When you reinvest those dividends, they buy you more shares. Those new shares then generate even more dividends, which buy even more shares.

It's a powerful cycle that builds on itself, creating a stream of income that grows bigger and bigger over time. This is your foundation—a steady, reliable engine for your passive income.

The Accelerator: Selling Covered Calls

If dividend investing is your engine, then covered calls are the turbo boost.

A covered call is a strategy where you sell someone the option to buy a stock you already own at a specific price. In return for giving them that option, they pay you an immediate cash payment called a premium.

Here's why this is such a game-changer:

Instant Cash: The premium you get is yours to keep, no matter what happens. You can take that cash and buy even more dividend stocks, making your passive income snowball grow even faster.

Lowering Your Cost: The premium effectively lowers the price you paid for your shares. It's a great way to make a little extra money while you hold onto your investments.

Making the Most of Your Stocks: Even if your shares get sold (which can happen if the stock price goes up enough), you still make a profit. You get to keep the premium, and you sell the shares at a higher price than you bought them for. It’s a win-win.

What’s the catch? Well, you could lose a little of the upside if a stock shoots up quickly and get’s sold (aka - called away). You still get the premium and the higher price up. But you miss out on any profit after the strike price. You win some. You lose some, I suppose.

The Synergy: A One-Two Punch for Income

The real brilliance of Simpson’s approach is in how these two strategies work together. You're not just waiting for dividends to come in; you’re actively generating more income from your portfolio to fuel its growth.

The cycle looks like this:

You get dividends. (growing every year)

You sell covered calls and get a premium.

You use both the dividends and the premiums to buy more shares.

More shares mean more dividends and more opportunities to sell covered calls.

This creates a powerful loop that accelerates your progress toward financial freedom. It’s a more hands-on way to build passive income, but it can get you to your goal a lot faster.

But What About the Nitty-Gritty?

Now, here’s where things get interesting. The "Walk Toward Wealth" book dives deep into the details of running a covered call strategy—the expirations, the strike prices, the management of a full portfolio. It's a lot of work!

And after reading through it, I realized that while I love the strategy, I’d rather leave the day-to-day execution to the pros.

This is where ETFs (Exchange Traded Funds) come in to save the day!

These funds offer a low-cost, hands-off way to implement a covered call strategy. You buy the fund, and the fund's professional managers do all the heavy lifting—picking the dividend-paying stocks and tactically selling covered calls on them.

It’s the perfect way to get the benefit of this powerful strategy without having to constantly manage the options yourself.

And what better place to start than with the Kevin’s own flagship fund, the Amplify CWP Enhanced Dividend Income ETF (DIVO). It's a fantastic example of this strategy in action, and its performance over the last decade proves that the concept works.

DIVO is built on the exact principles we've been discussing: it holds a basket of high-quality, dividend-growing stocks and then uses a tactical covered call strategy to boost the income.

Let's break down DIVO a little more to see how it works:

Top Companies: DIVO's portfolio is a who's who of blue-chip companies you know and use every day. The top 10 holdings (as of August 2025) included big names like Microsoft, Visa, and JPMorgan Chase.

Performance: Since its inception in 2016, DIVO has shown a history of strong performance, providing both a steady stream of income and the potential for capital appreciation. It's a great example of how this strategy can hold up over time and across different market conditions.

Yield: A key feature of DIVO is its attractive 4.65% dividend yield, which is generated from both the dividends of its underlying stocks and the premiums from the covered calls. This monthly income stream is exactly what you need to fuel your own passive income snowball.

DIVO is an excellent starting point for anyone who wants to put the "Walk Toward Wealth" strategy into action without becoming a full-time options trader. It allows you to build your wealth with a smart, proven strategy while freeing up your time to do the things you love.

A Sneak Peek at My New Project

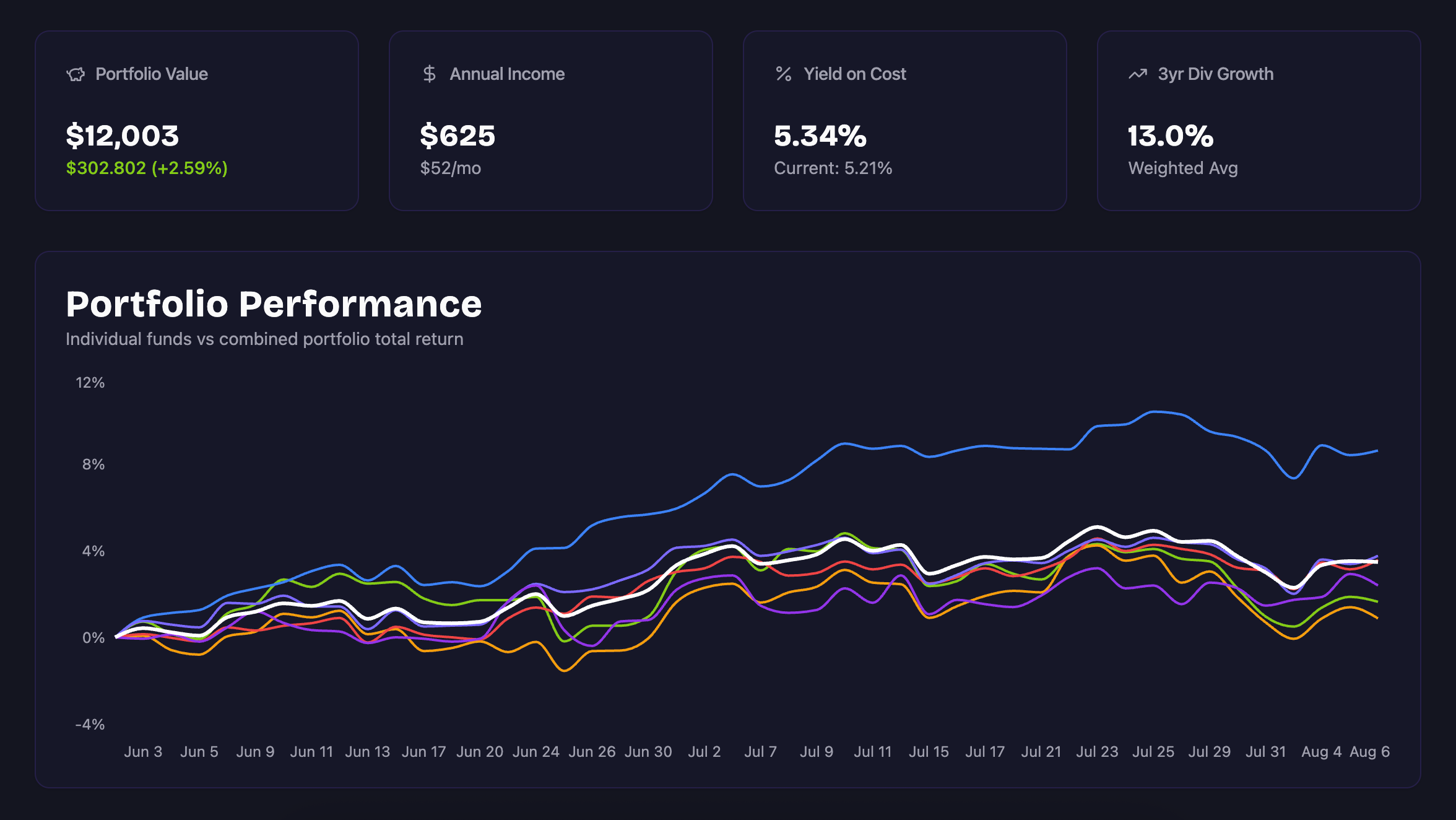

Inspired by Kevin Simpson’s strategy, I’m launching a new project to show you exactly how this works in the real world. My Wealth Walk portfolio (a personal app I’m building with AI!) will be built with six carefully chosen dividend funds.

I've picked funds (spoiler: one is DIVO) instead of individual stocks because they offer a lot of benefits. They give you diversification across many companies, they're professionally managed, and they tend to have a more predictable dividend stream. By using funds, we can simplify the process of earning dividends and selling covered calls.

The Wealth Walk web app will track the progress, highlight the top overlapping companies between the 6 funds and provide fun dividend metrics to make the walk more rewarding.

My hope, is that the new portfolio will give you ideas to help you on your journey to financial freedom.

Over the next few weeks, I’ll be sharing more details on why I chose each of the six funds and giving a step-by-step guide on how they use dividend growth plus covered calls to generate extra income. This isn't just theory; it's a real-world example of how to build a passive income stream using this powerful one-two punch.

Want to see how I’ll put this strategy into action? Follow along with me on the Wealth Walk!

Until next time, keep walking

Jeremy ✌️

Disclaimer

This article is for informational and entertainment purposes only. I am not a financial advisor, broker, or tax professional. The information provided reflects my personal opinions and experiences as an individual investor and may not be accurate or current. All investment strategies and investments involve risk of loss. Any ideas presented may not be suitable for all investors and may not take into account your specific investment objectives, financial situation, or needs. Past performance is not indicative of future results. Always conduct your own due diligence and consult with qualified financial professionals before making any investment decisions.

Love this initiative. I look forward to more details!

I noticed $WELL in the portfolio as the REIT pick.