The Magic of Dividend Growth

A case study with the home improvement giant, Lowes

Day 54 | $5,000

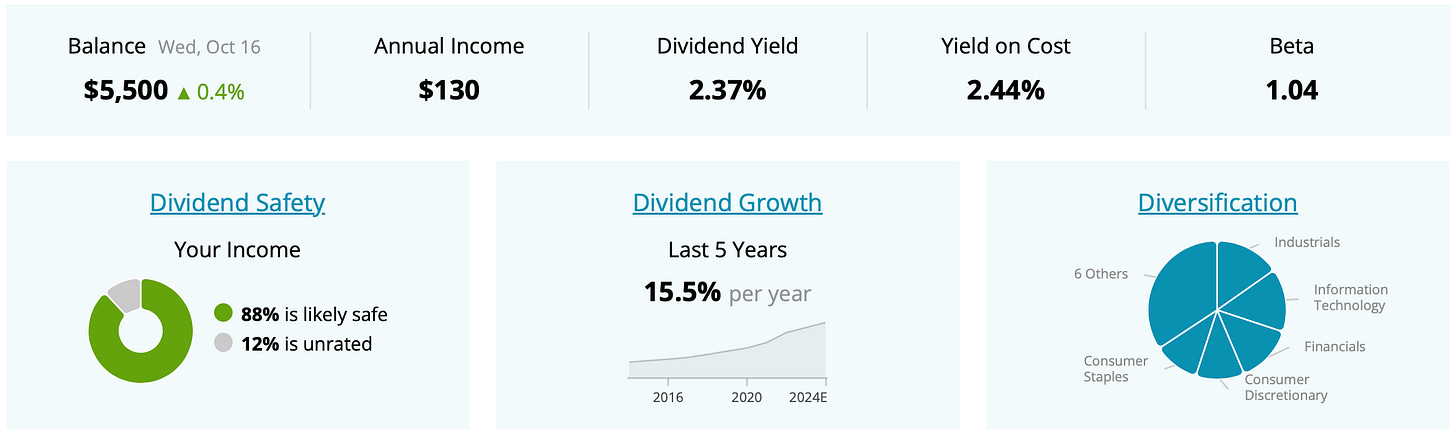

Today, I wanted to share how much dividend income I’m making from my “Walk to Wealth” portfolio after reaching the $5,000 milestone!

It’s important to know, that dividend growth is often compared to a snowball rolling downhill. It’s starts small, but grows exponentially overtime.

The portfolio currently yields 2.37% and with a value of $5,000 we have:

$130 in annual passive income

$10.80 in monthly passive income

Now I want to take a minute to show you the real power of dividend growth!

Dividend growth investing is a powerful strategy that combines the benefits of passive income with the potential for compounding wealth. Let’s explore how this approach works, its long-term potential, and why it can transform your portfolio into a wealth-generating machine.

What Makes Dividend Growth Investing Magical?

Dividend growth investing focuses on companies with a consistent history of increasing their dividend payouts. These companies often have strong financial health, disciplined management, and stable cash flows, making them reliable sources of income and growth over time.

Why Dividends Are Special

Real Cash Flow: Dividends represent actual cash paid to you, not just a promise or projection. You can reinvest them or use them as income—it’s your choice.

Compounding Power: Reinvesting dividends allows you to buy more shares, which in turn generate even more dividends. Over time, this compounding effect can significantly accelerate wealth accumulation.

Inflation Hedge: Growing dividends help maintain purchasing power by outpacing inflation.

A Real-World Example: Lowe's as a Dividend Compounder

Let’s take Lowe’s Companies Inc. (LOW), a home improvement giant, as an example of how dividend growth investing works in action.

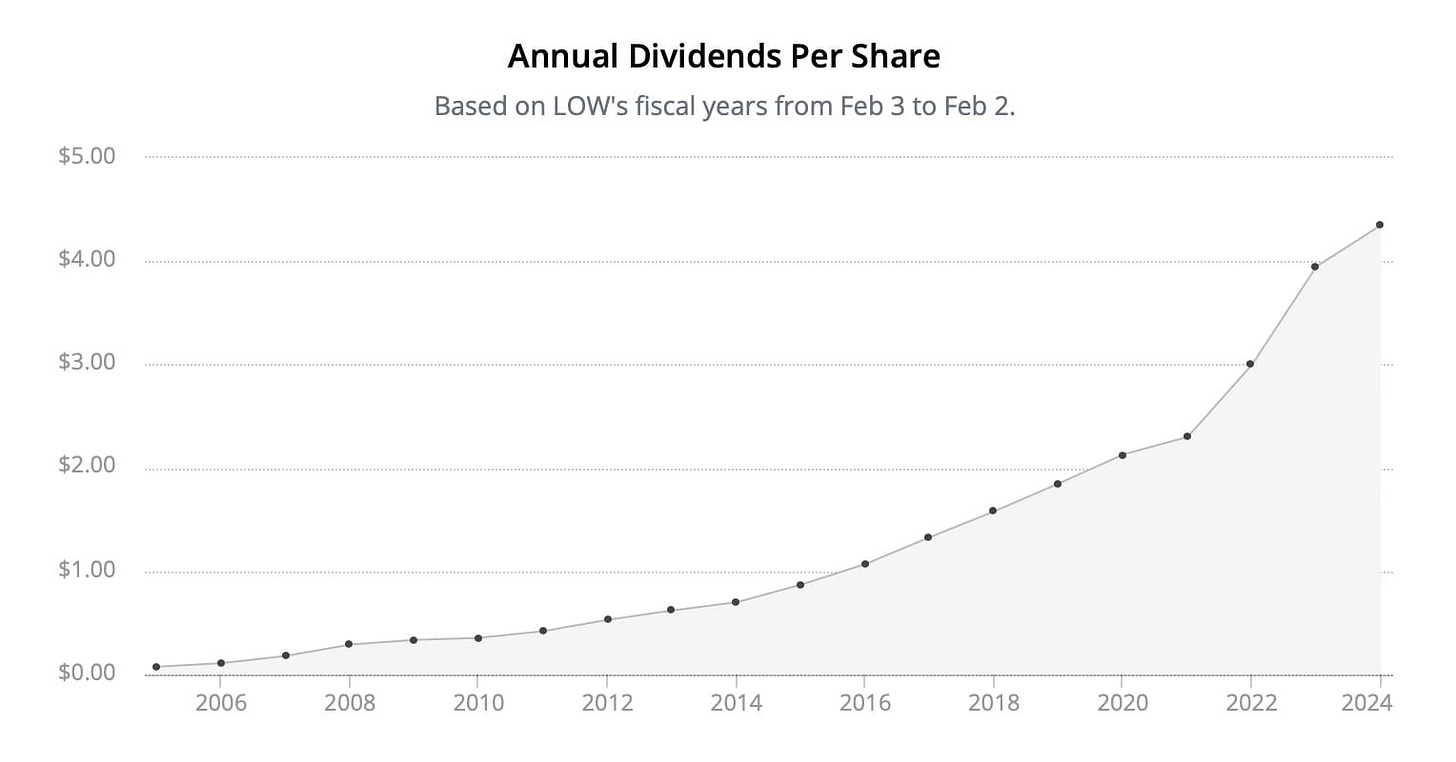

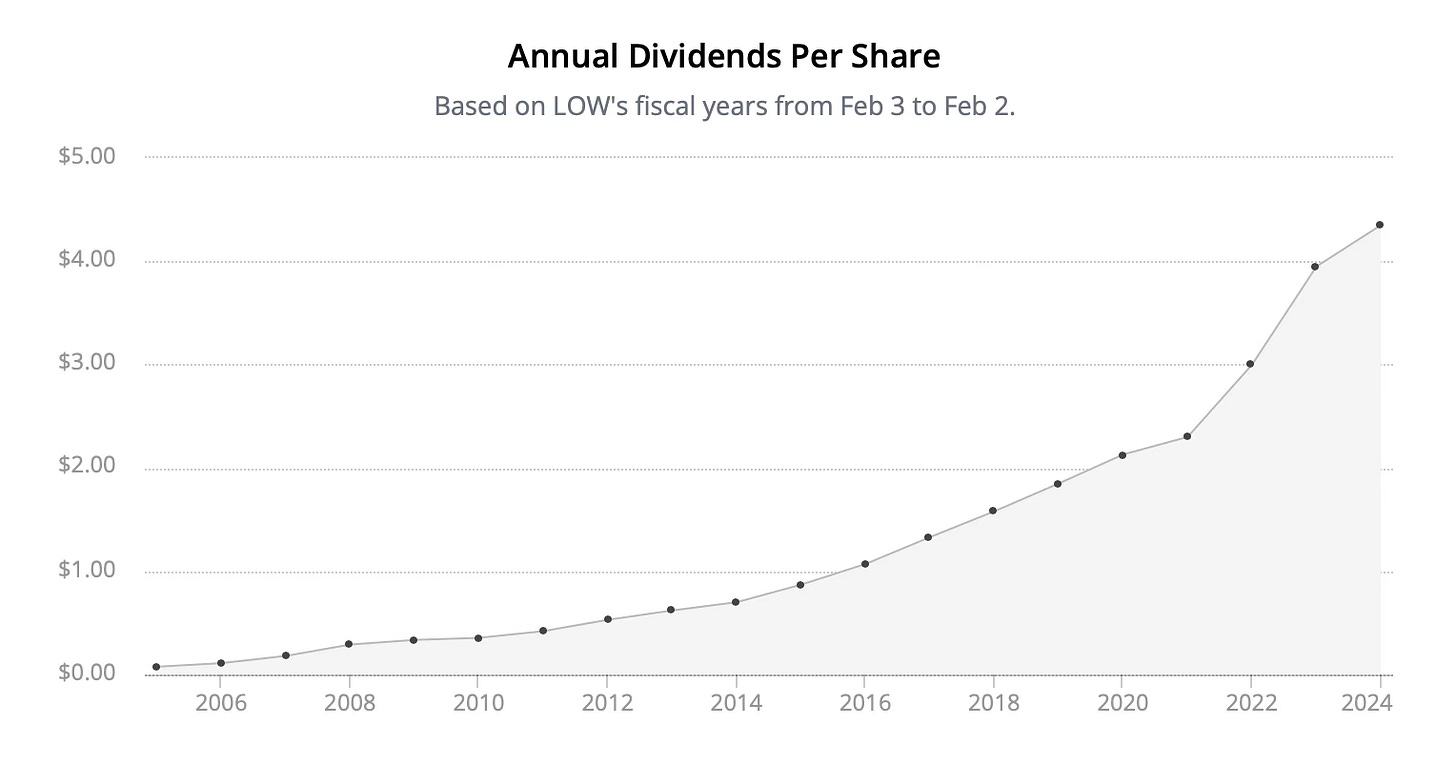

Lowe’s Dividend Growth Track Record

Over the past 5 years, Lowe’s has grown its dividend by an impressive 19% annually. Its 20-year average growth rate is even higher at 24% per year-that's crazy good!

This consistent growth demonstrates Lowe’s financial strength and commitment to rewarding shareholders.

From Cents to Dollars

In 2010, one share of Lowe’s paid just $0.35 in annual dividends. Fast forward to 2024, and that same share now pays $4.35—a more than 12-fold increase! This growth transforms small payouts into meaningful income over time.

What If You Invested $10,000 in 2010?

Your $10,000 would have bought 463 shares of Lowe’s in 2010.

In your first year, you’d earn $162.11 in dividends.

By 2024, those same shares would generate $2,014.83 annually in dividends—a whopping increase.

On top of that, your initial investment would have grown to nearly $100,000 in capital appreciation.

The Compounding Effect of Reinvesting Dividends

Reinvesting dividends amplifies the power of compounding. By using a Dividend Reinvestment Plan (DRIP), you can automatically reinvest your dividends to purchase additional shares without paying commissions. Over time:

You accumulate more shares.

Each new share generates its own dividends.

The cycle repeats, creating exponential growth.

For instance, if you reinvested all your Lowe’s dividends since 2010, your total returns would be even higher due to the additional shares purchased along the way.

Why Choose Dividend Growth Investing?

Reliable Income Stream: Dividend growers provide consistent and increasing payouts, offering stability during volatile markets.

Capital Appreciation: Companies with a history of dividend growth often see their stock prices rise alongside their payouts.

Risk Mitigation: Dividend-paying stocks tend to be less volatile than non-dividend payers and can help reduce portfolio risk.

Let's Wrap This One Up...

Dividend growth investing is more than just a strategy—it’s a long-term wealth-building philosophy.

By focusing on companies like Lowe’s with a proven track record of growing their payouts, you can enjoy the dual benefits of increasing income and capital appreciation.

Whether you’re reinvesting dividends now or planning to live off them later, this approach has the potential to turn your portfolio into a financial powerhouse.

Until next time, keep walking!

Jeremy ✌️

I think it’s important to show you what you can realistically expect for your own journey.

It’s common to hear dividend investing as a one-size fits all. But the reality is there’s quite a few different flavors and a huge difference between investors looking for high dividend yields right now versus those who are willing to be patient and prioritize long-term dividend growth.

Companies with higher dividends are best suited for those ready to live off the income. The drawback here is that those companies shelling out those high yields aren’t usually growing much. There’s an immediate reward but limited future gains.

As a dividend growth investor (DGI) it’s important to remember that we’re focused more on long-term growth. This means that we’re creating a dividend snowball. It starts small, but speeds up as it gains momentum rolling down the hill.

Dividend growers are high quality companies that create a double-edged sword. As the dividend checks build year after year, your portfolio’s overall value continues to grow with it.

And by simply reinvesting those dividends, we can compound while the snowball is rolling downhill.

All of that to say, dividend growth portfolios like my “Walk to Wealth” one, won’t start out with super high dividend payouts, but overtime, the income will keep building on itself. The longer you can hold on to the same companies the more money you can accumulate as your snowball picks up speed.

Here a Quick Example…

Lowes has been growing its annual dividend payout by 24% for the last 20 years.

Let’s imagine 💭 you invested $10,000 in Lowes back in 2010. That would have gotten you 463 shares. Which means, you would have earned $162 in dividends that first year. Nothing crazy, right?

Fast forward to today, those same exact shares that you bought 14 years ago would be paying you over $2,000!

Every year you are making more money on the investment you’ve already made thanks to the dividend snowball you set in motion years ago.

That’s the power of compounding and the reason I’m all in on being a dividend growth investor!

Now let’s check out the portfolio to see what you can expect once you hit the $5,000 mark

To set the stage, it’s October 2024 and we are sitting at $5,500 in total portfolio value.

Portfolio Age

We’re currently at day 54!

In my experience (I’ve been investing into individual stocks for about 2 years now), time is your best friend as an investor. And at 54 days, we’re still babies.

The portfolio has gained about 4%, which is pretty good for such a short run. A running joke (or maybe source of truth) is that most stocks drop in value the minute you decide to buy! 🤪

So for now, we’ll take it.

Dividend Yield

Some good news here! Our dividend yield has already increased from 2.30% to 2.37%. This is because a few companies have raised their dividends since the portfolio launched.

Agree Realty raised their dividend by 1.2%

Canadian Natural Resources raised their dividend by 7.1%

Texas Instruments raised their dividend by 4.6%

Microsoft hiked their dividend by 11%

Broadcom slightly raised their dividend by 0.95%

Essential Utilities increased their dividend by 6%

Like all things investing (and life), it’s the small steps that add up overtime.

While our dividend yield sets at 2.37%, the dividend yield on cost has grown to 2.44%.

Let me explain how yield on cost works and why this is a key metric for dividend growers!

What is Yield on Cost?

Yield on cost is the current annual dividend (your paycheck) divided by your original purchase price.

Let’s say you invested $10,000 in ABC Company, which has a 4.4% dividend yield.

Let’s also assume the company is growing its dividend by an average of 4% for 10 years. (Which is much lower than our portfolio 5-year average over 15%)

After 10 years, you’ll be earning over $600 per year on that exact same $10,000 investment you originally made. And after 20 years, your annual paycheck would jump up close to $900. And after 30 years, it’s over $1,300.

Your yield on cost after 30 years would be around 13%! Remember you started with a 4.4% dividend yield but the yield on cost (what you are making today) is 13%!

If anything else, this should encourage you to be a long-term investor and hold your dividend growing companies for a long as possible!

30 years our is great, but how much income are we making today with our $5,000 investment?

Great question!

With a $5,000 investment and 2.37% dividend yield, you can expect a $130 annual paycheck.

This breaks down to $10.83 per month.

Circling back to our earlier discovery, dividend income is like a snowball rolling down a hill, it takes time to build momentum.

To stay motivated, I like to give myself some fun milestones. With $10.83 a month I can buy about 2 cups of coffee at Starbucks or cover my Netflix subscription!

Now this isn’t a game changer, but remember we are just starting out. One day, I’ll look to have enough dividends to pay for my mortgage and eventually to live off of when I retire.

The Wrap Up…

I hope you enjoyed a transparent look behind a $5,000 dividend growth portfolio.

I’ll be sure to bring more of these updates to you as the portfolio grows. Subscribe if you haven’t…