The Dividend Payback Matrix

Calculating the value of dividends

Day 161 | Portfolio $57,000

This is not financial advice! Do your own research or consult a financial advisor before making any investment.

Today I have a fun one for you! Inspired by an article I saw on Fidelity’s website, I got my favorite AI, Perplexity, to create a table so I could calculate the true value of the dividend income for different companies. You can use this concept for your own stocks or for stocks you are looking to buy.

The question: Are the dividends worth the wait?

We created “The dividend payback matrix”, which is a powerful tool for dividend investors to understand how long it would take to recoup their initial investment through dividends alone. This concept helps establish a baseline performance expectation, especially valuable in uncertain market conditions (aka—when a company’s stock price dips or remains flat).

Understanding the Dividend Payback Concept

When you invest in a dividend-paying stock, two key factors determine your payback period:

The initial dividend yield

The annual dividend growth rate

Let's look at how a $10,000 investment with a 3% dividend yield performs under different growth scenarios:

No Growth Scenario:

Initial annual dividend: $300

With no dividend growth, it would take 33 years to recoup the $10,000 investment

10% Annual Growth Scenario:

Initial annual dividend: $300

With 10% dividend growth, the payback period reduces to 16 years

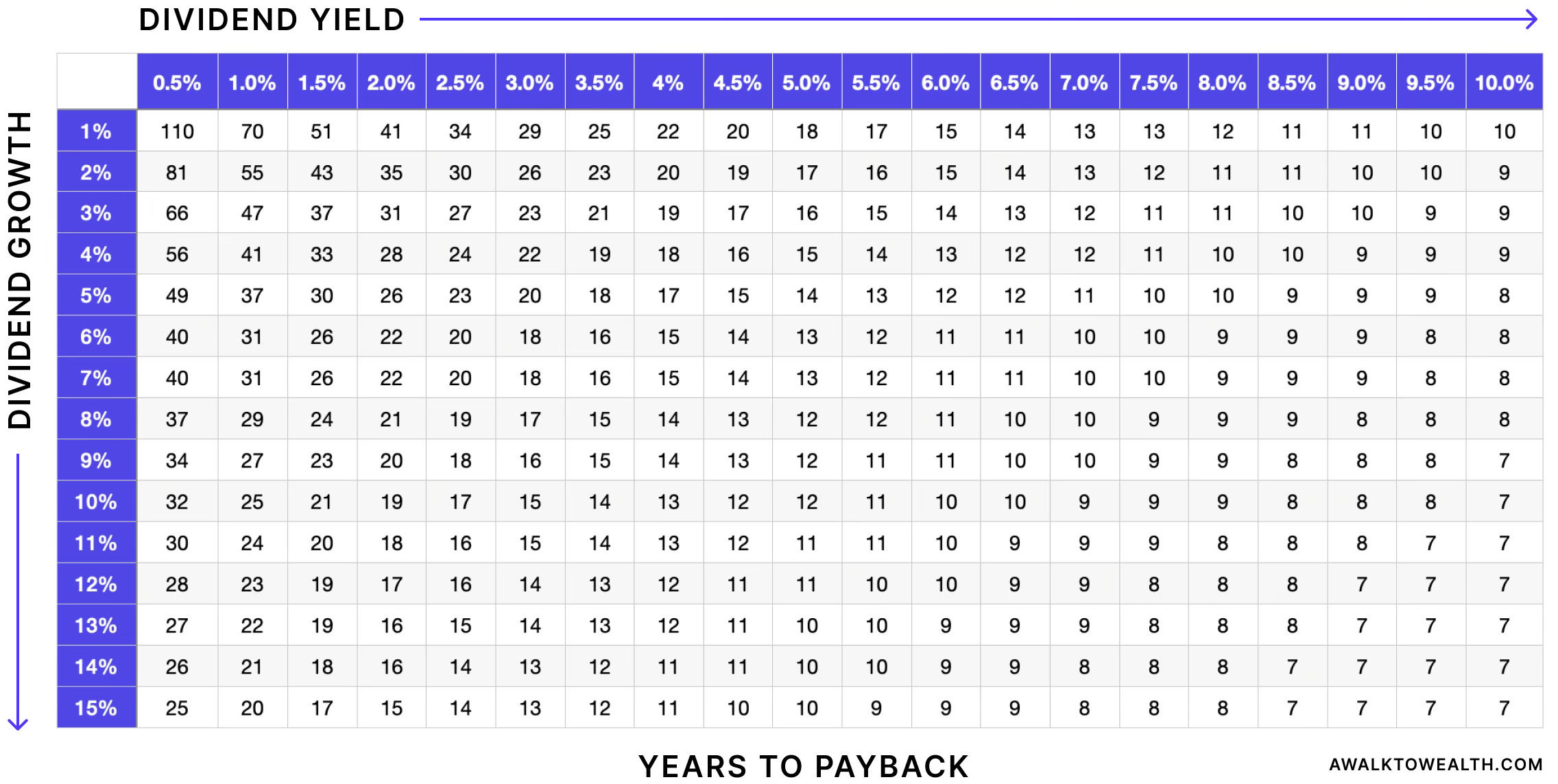

Using the Payback Matrix

The matrix below is designed to help investors quickly estimate dividend payback periods for different stocks. Here's how to use it:

Find the current dividend yield along the horizontal axis (X-axis)

Locate the expected dividend growth rate on the vertical axis (Y-axis)

The intersection shows the approximate years needed to recover your investment

The Payback Matrix

Practical Application

The matrix demonstrates a crucial investing principle: higher dividend yields and growth rates dramatically reduce the payback period. For instance, a stock with a 6% yield and 10% annual dividend growth could return your initial investment through dividends in just 10 years, compared to 50 years for a 2% yield with no growth.

Important Considerations

Remember that this analysis focuses solely on dividend payments and doesn't account for:

Stock price appreciation

Tax implications

Company's ability to maintain dividend payments

Market conditions affecting dividend sustainability

Real Portfolio Examples

My 30-stock portfolio strikes a balance between high-yield companies and those with a lower yield but fast dividend growth. Let’s look at how both scenarios can be attractive based on the “dividend payback matrix”.

High-Yield Strategy: LyondellBasell (LYB) - A Chemical Company

With LYB's 7% forward dividend yield and ~5% dividend growth rate, we can calculate the payback period:

Initial annual dividend on $10,000 investment: $700

Using our matrix, a stock with these characteristics would repay the initial investment in approximately 11-12 years

This demonstrates how a higher initial yield significantly reduces the payback period, even with modest dividend growth

Growth Strategy: Zoetis (ZTS) - An Animal Pharmaceutical Company

ZTS presents an interesting contrast with its 1.21% yield and ~21% dividend growth rate:

Initial annual dividend on $10,000 investment: $121

Despite the low initial yield, the aggressive 21% growth rate results in a payback period of approximately 13-14 years

This shows how strong dividend growth can compensate for a lower initial yield

Comparing the Strategies

Both companies would theoretically return the initial investment through dividends alone in a similar timeframe (11-14 years), despite taking very different paths:

LYB achieves this through high immediate income

ZTS relies on compound growth of smaller initial payments

This comparison demonstrates that multiple dividend strategies can achieve similar payback periods, allowing investors to choose an approach that matches their income needs while maintaining comparable long-term efficiency.

What Dividend Strategy Works for You?

Choosing the right dividend strategy ultimately depends on your investment goals, time horizon, and income needs. Let's explore how different approaches might fit various investor profiles:

High-Yield Strategy

This approach, exemplified by stocks like LYB, is ideal for retirees and investors seeking immediate income streams. It appeals to those who prioritize predictable cash flow over potential capital appreciation and want to supplement their current earnings.

High-Growth Strategy

The growth approach, demonstrated by stocks like ZTS, typically suits younger investors with longer time horizons who don't need immediate income. These stocks often deliver superior total returns through a combination of dividend growth and capital appreciation.

The "Just Right" Approach

Many successful dividend investors, myself included, prefer a balanced portfolio combining both strategies. This approach provides immediate income from high-yield positions while capturing the long-term growth potential of dividend growers. It offers natural diversification across sectors and business cycles, allowing investors to enjoy both current income for today's needs and growing income for tomorrow's goals.

Remember, the "right" strategy isn't about choosing between high yield or high growth – it's about building a dividend portfolio that aligns with your personal financial goals and comfort level.

The “dividend payback matrix” is one tool to help you get there!

Until next time, keep walking!

Jeremy ✌️

Disclaimer

This article is for informational and educational purposes only. I am not a financial advisor, broker, or tax professional. The information provided reflects my personal opinions and experiences as an individual investor and may not be accurate or current. All investment strategies and investments involve risk of loss. Any ideas presented may not be suitable for all investors and may not take into account your specific investment objectives, financial situation, or needs. Past performance is not indicative of future results. Always conduct your own due diligence and consult with qualified financial professionals before making any investment decisions.

Hey Jeremy. Nice writing here. Congrats. One thought: is it possible to consider dividend reinvestment in your matrix? Cheers