The Dividend Growth Blueprint

Balancing growth and yield with ETFs

Day 676 | Portfolio $66,956

Navigating the path to financial freedom requires a strategic approach to investing, especially when time is of the essence! For those aiming to achieve financial independence within the next 10-15 years, building a portfolio that balances dividend growth and dividend yield is crucial.

Dividend growth ensures your income stream increases over time, keeping pace with inflation, while a solid yield provides immediate cash flow to support your lifestyle or reinvestment goals.

Dividend ETFs (Exchange-Traded Funds) offer a practical solution, combining diversification with targeted strategies to meet these dual objectives.

In this post, we’ll explore why this balance matters and break down five ETFs that can form the backbone of your dividend-focused portfolio. We’ll also demystify covered call ETFs for beginners, as they play a key role in enhancing yield.

Why Dividend Growth and Yield Matter for Financial Freedom

If you’re like me and already hit 40, the window to build wealth narrows, making every investment decision count. This is especially true if you’re newer to the investing game. You need a plan that works smarter (and harder!)

Dividend growth ETFs focus on companies with a history of increasing payouts, which can compound over time and protect your purchasing power. This growth is often the primary focus, as it builds a foundation for a sustainable income stream that can support you in the long run.

However, while growth is critical, a high yield is equally essential for the later stages. When you’re ready to step away from earned income, you’ll need a substantial yield to live off of—a reliable cash flow to cover expenses without dipping into your principal.

In the meantime, those higher dividends act as a powerful boost, especially if reinvested. Think of it as an extra push that sends the snowball of your wealth rolling faster down the hill. Reinvesting these dividends accelerates compounding, helping you build a larger nest egg in a shorter time frame.

Striking this balance between growth and yield through ETFs allows you to prepare for the future while maximizing growth today, reducing the risk of individual company failures and the hassle of stock-picking.

Breaking Down 5 Dividend ETFs: Growth and Yield Strategies

Let’s dive into five ETFs that cater to dividend growth and yield, each with a distinct approach to help you craft a balanced portfolio. I’ve split them into two categories—dividend growth and dividend yield—for clarity.

Dividend Growth ETFs: Building for the Long Term

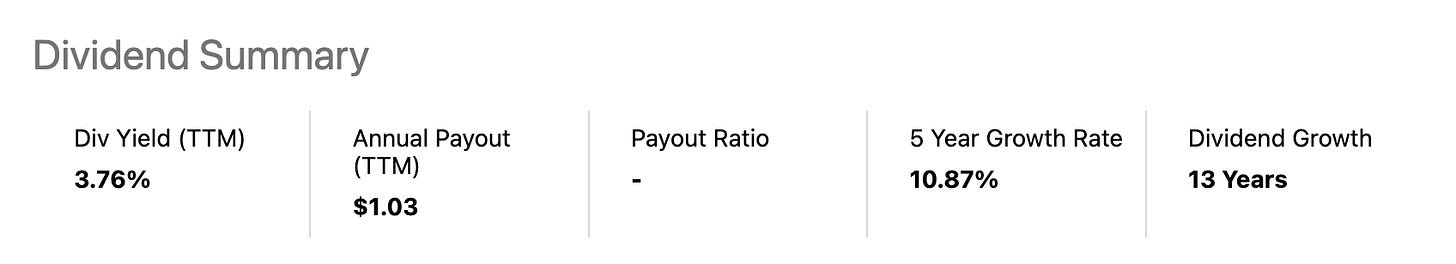

1. SCHD (Schwab U.S. Dividend Equity ETF)

SCHD tracks the Dow Jones U.S. Dividend 100 Index, focusing on high-quality companies with a track record of consistent dividend payments and growth. It prioritizes firms with strong fundamentals, like low debt and high return on equity, making it a cornerstone for long-term income growth. As of recent data, SCHD offers a yield of around 3.5% while maintaining a low expense ratio of 0.06%, ensuring more of your money stays invested.

SCHD’s top 10 holdings

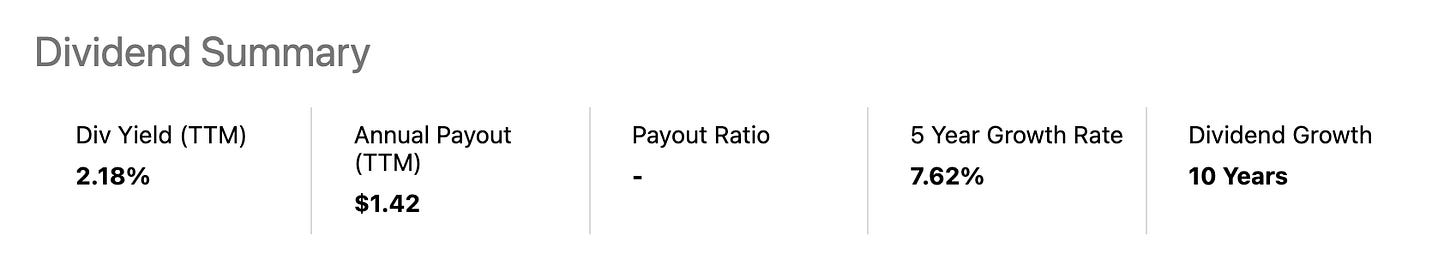

2. DGRO (iShares Core Dividend Growth ETF)

DGRO targets U.S. companies that have increased dividends for at least five consecutive years, emphasizing sustainability. It’s designed for investors seeking steady growth with a yield of approximately 2.3% and an expense ratio of 0.08%. Its broad exposure across sectors helps mitigate risk, making it a reliable choice for those building wealth over the next decade.

DGRO’s top 10 holdings

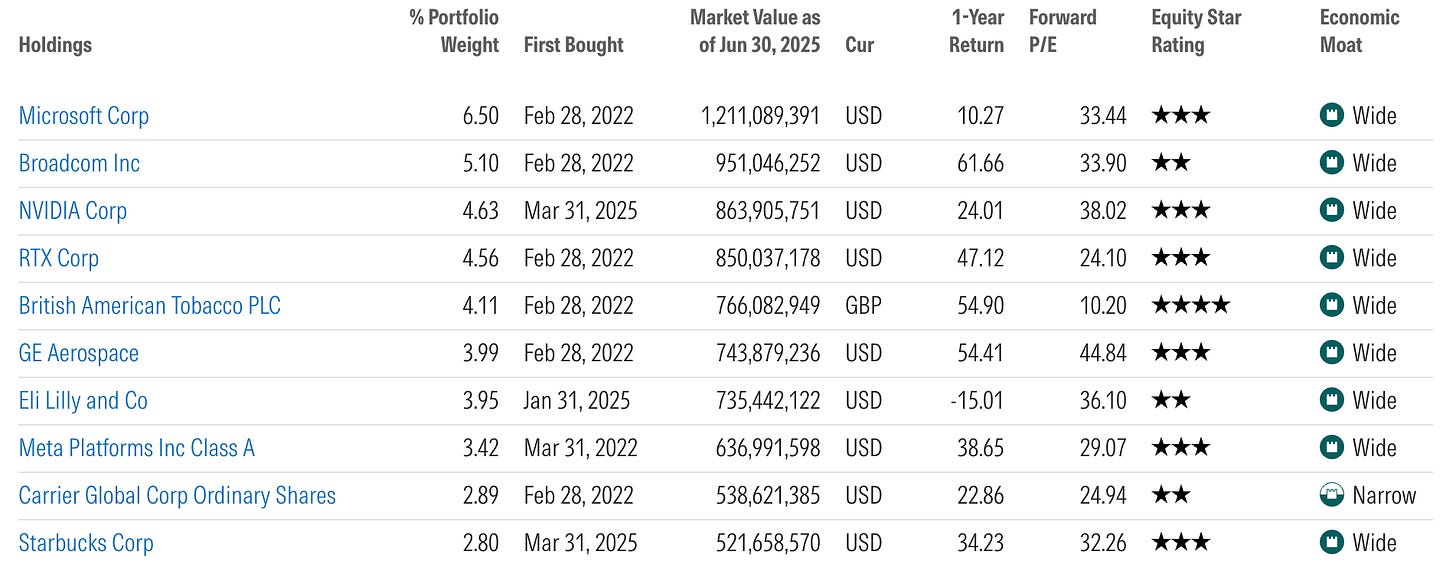

3. CGDV (Capital Group Dividend Value ETF)

CGDV is a newer, actively managed ETF, that seeks companies with strong dividend growth potential and attractive valuations. It blends growth and value strategies (with a more technology tilt), aiming for both income and capital appreciation. With a lower yield near 1.5% and an impressive 11% dividend growth rate, it offers a more hands-on approach compared to passive index funds, appealing to investors who trust active management to navigate market shifts.

CGDV’s top 10 holdings

Dividend Yield ETFs: Boosting Income with Covered Calls

4. DIVO (Amplify CWP Enhanced Dividend Income ETF)

DIVO is an actively managed ETF that uses a covered call strategy on high-quality, dividend-paying stocks to enhance yield. It aims to provide monthly income with a current yield of around 4.5% and an expense ratio of 0.55%.

By writing covered calls, DIVO generates additional income from option premiums, which can be especially valuable in flat or volatile markets. DIVO only writes calls on a portion of the individual stocks in the portfolio allowing it top capture more capital appreciation compared to some other covered call funds.

DIVO’s top 10 holdings

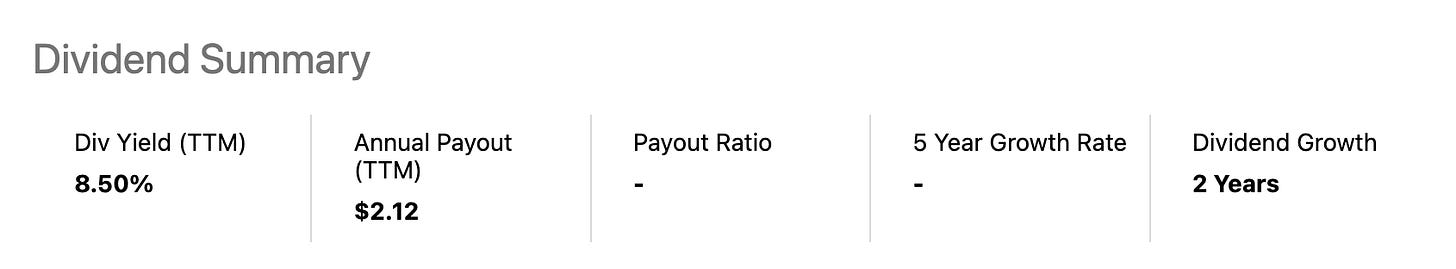

5. RDVI (FT Cboe Vest Rising Dividend Achievers Target Income ETF)

RDVI combines a focus on companies with rising dividends with a covered call strategy to target higher income. It offers a yield of approximately 8-9% through its options overlay, with an expense ratio of 0.75%. This ETF is ideal for those prioritizing immediate cash flow while still capturing some dividend growth potential.

RDVI is the younger sibling to RDVY, which holds the same underlining stocks but without the cover calls. RDVY has outperformed the S&P 500 in total returns (capital appreciation plus dividends) for the last 1yr, 3yr, 5yr, and 10yr intervals.

RDVI’s top 10 holdings

How Covered Call ETFs Work: A Beginner’s Guide

Covered call ETFs add additional yield based on their options strategy. It might sound complex, but their core concept is straightforward. Here’s a quick breakdown:

What is a Covered Call? A covered call is an options strategy where the ETF owns shares of a stock and sells (or “writes”) call options on those shares. A call option gives the buyer the right to purchase the stock at a set price (strike price) by a certain date. The buyer pays a premium for the “option.” If the stock price stays below the strike price, the option expires worthless, and the seller keeps the premium paid by the buyer as extra income.

How It Boosts Yield: The premiums collected from selling these options add to the dividends received from the underlying stocks, increasing the ETF’s overall yield. This can be a powerful way to generate income, especially in markets where stock prices aren’t rising significantly.

The Trade-Off: The downside is that if the stock price surges above the strike price, the ETF may have to sell the shares at the lower agreed-upon price, missing out on some capital gains. However, for income-focused investors, this trade-off is often worth the consistent cash flow.

Balancing Yield and Growth: Both DIVO and RDVI focus on dividend-growing companies, ensuring that their underlying portfolios are built on firms with a history of increasing payouts. Additionally, they typically write calls on only a portion of their portfolio, allowing them to balance the enhanced yield from option premiums with capturing the appreciation of the underlying stocks. This strategic approach helps maintain some growth potential while prioritizing income.

Why It Fits After 40: Covered call ETFs are particularly appealing when you’re closer to retirement, as they prioritize income over aggressive growth, providing a steady stream of payouts to support your financial freedom goals.

Crafting Your Blueprint

Building a dividend portfolio after 40 is about blending the stability of growth with the boost of yield. ETFs like SCHD, DGRO, and CGDV lay the foundation for increasing income over time, while DIVO and RDVI supercharge your current cash flow through covered call strategies.

You can tailor the strategy based on your age to make it work for you!

Start by assessing your timeline and income needs—allocate more to growth if you have 15-30 years, or lean toward yield if you’re targeting freedom in 10 or less.

I hope this give you some fun ideas to look into. In the next post, I’ll be showing how I am using this exact strategy… stay tuned!

Until next time, keep walking.

Jeremy ✌️

Disclaimer

This article is for informational and educational purposes only. I am not a financial advisor, broker, or tax professional. The information provided reflects my personal opinions and experiences as an individual investor and may not be accurate or current. All investment strategies and investments involve risk of loss. Any ideas presented may not be suitable for all investors and may not take into account your specific investment objectives, financial situation, or needs. Past performance is not indicative of future results. Always conduct your own due diligence and consult with qualified financial professionals before making any investment decisions.

For someone in their 40s, CGDV seems to strike a nice balance. Solid growth potential without taking on too much risk. Reinvesting the dividends is the key here.