The Case for the Dow Jones 👑

Building a portfolio from original blue chip, dividend stocks

Hey friends! If you’re tired of chasing the latest tech frenzy and want to build a rock-solid portfolio that pays you consistently, let’s talk about an old-school champion: The Dow Jones Industrial Average.

I’m sure you’ve heard folks on TV saying “the Dow is up 100 points today.” If you haven’t caught that one lately, it’s because it’s often mentioned alongside it’s younger siblings, the S&P 500 and the Nasdaq - which have been getting all the attention lately.

But what if the Dow isn’t the boring and outdated sibling everyone thinks it is? What if it’s one of the best shortcuts to quality dividend stocks available?

Part I: A Story of 30 Blue Chips (and a Secret Committee)

The Dow Jones isn’t just a index; it’s a 129-year-old barometer of American economy.

The Fun Facts:

The Original 12: When Charles Dow created the index in 1896, it had just 12 companies (think cotton, sugar, tobacco, and coal). Back then, these 12 companies represented the backbone of the US economy. Today, none of the original 12 are left! General Electric (GE) was the last of the original 12 to exit. GE said goodbye in 2018.

The Secret Committee: Throughout it’s existence, there’s always been a mystery in the selection process. The 30 stocks aren’t chosen by some huge algorithm. They are selected by a small, secretive committee of just five people (executives from S&P Dow Jones Indices and The Wall Street Journal). Their job is to pick the 30 companies that best represent the overall health and direction of the U.S. economy.

The Flaw: Though its name suggests simplicity, the Dow uses a quirky, decades-old formula. Instead of using market capitalization (the total value of all shares, which is how the S&P 500 is calculated), the Dow is price-weighted. In simple terms: if Company A has a $300 stock price and $100 billion in market value, it moves the index more than Company B, which might have a $50 stock price but $500 billion in market value. Critics argue this distorts the index, giving more influence to an arbitrary share price than to the actual size and economic impact of the company.

Admittedly, it’s the antiquated price-weighted methodology that has kept me on the outside looking in. If the strategy is old, then the companies inside must be too, right?

From Old-School to AI

From railroads to the internet, the Dow has always been at the center of what makes the US economy move. If you pass by the Dow thinking it’s too old-fashioned, you’d miss companies at the forefront of a new AI revolution. Today, it’s adapting faster than many give it credit for.

Companies like Microsoft, Salesforce, and the latest company added, Nvidia, are leading the charge. But critically, every single company in the Dow - from United Health to JPMorgan - has massive capital to invest in AI to boost innovation and efficiency. When the economy shifts, the Dow’s giants have the money to pivot, making them resilient dividend payers.

Part II: How to Invest in the Dow

One of the easiest ways to own the Dow is to buy a Dow-based ETF. And thankfully, you have a few to choose from:

DIA (The Benchmark): The standard and most popular Dow ETF. It’s offers the cheapest expense ratio, but it’s price-weighted like the index. The highest-priced stock (not the most valuable or highest-yielding) has the biggest impact. This is the closest you can get to mirroring the index.

EDOW (First Trust Dow 30 Equal Weight ETF): This ETF attempts to “fix” the price-weighting flaw by giving equal weight to all 30 companies. Every stock has the same influence, which can lead to better diversification and performance when the lower-priced stocks outperform. But it has a significantly higher expense ratio (~0.50%) than DIA, eating into your long-term returns.

DJIA (Global X Dow 30 Covered Call ETF): A high-income strategy. This fund buys all 30 Dow stocks and then sells covered call options against them. It Generates a very high monthly income stream (often yielding over 10%) from the option premiums, but the strategy caps your upside - if the Dow surges, you miss out on most of the big gains.

DJD (The Yield Chaser): This one is tempting. It tracks a yield-weighted Dow index, meaning it owns more of the highest-yielding stocks. But here’s the flaw: its strategy forces it to sell the winners (whose prices have risen and thus lowered their yield) and buy the laggards. This drag often leads to lower total returns and slower dividend growth over the long run.

In the chart below, you can see the total return for each ETF over the last 10 years. Keep in mind that JDIA and EDOW don’t have a full 10 year history, but it’s clear that the ETF that follows closest to the index, DIA (even with it’s price-based weighting) has the highest total return at 218%.

These are 4 great options, but they all have flaws that prevents them from being the perfect dividend vehicle.

So what’s the solution? Well, what if you built your own portfolio based on your favorite companies within the 30-stock index?

Part III: Build Your Own Dow Dividend Fund (The Funnest Option)

This is the fun part! You get to act as your own secret Dow Committee, picking the 10-15 best dividend payers from the 30 elite companies.

This DIY approach lets you select companies based on your goals. For dividend lovers like me, you can build your own portfolio that balances high current yield and dividend growth potential.

A 10-Stock Dividend Portfolio: High Quality & High Yield

I spent the last few days running different scenarios to balance yield and growth. Here’s a breakdown of all 30 stocks in the Dow with their dividend yield, 1-, 5-, and 10- year dividend growth rates.

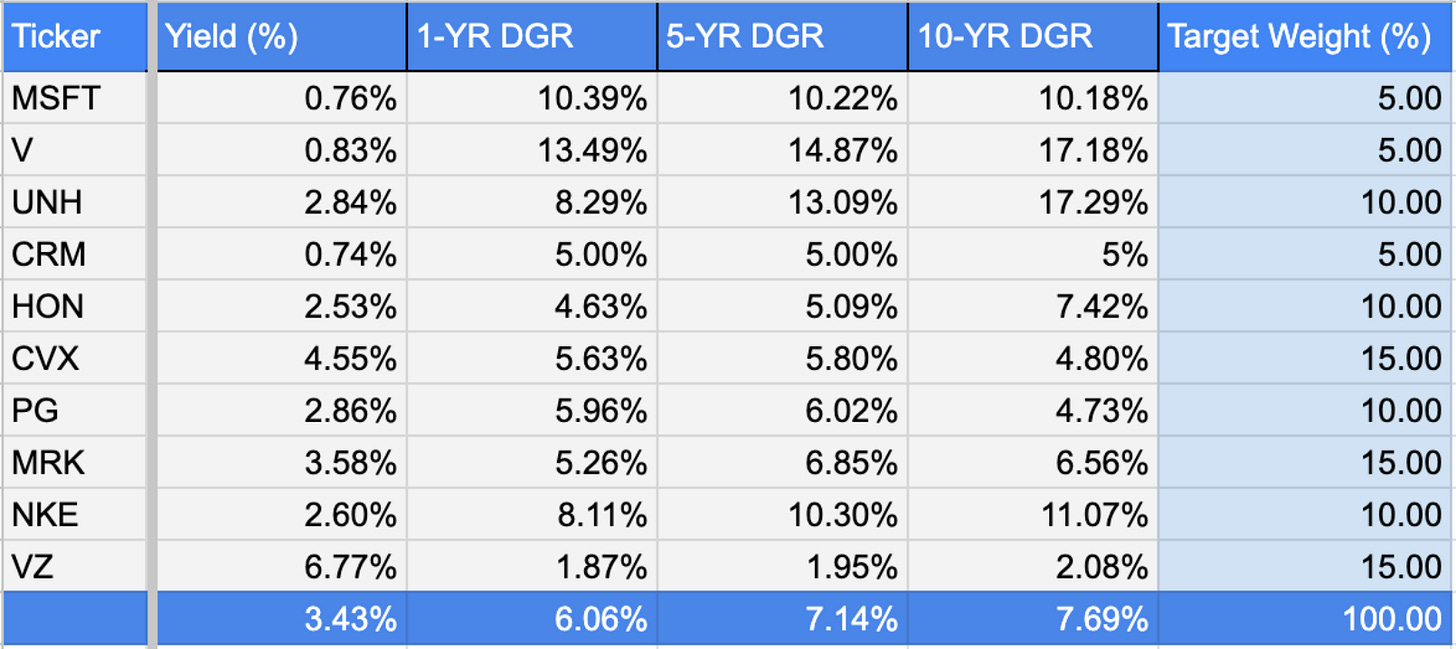

Finally, I landed on this 10-stock “Dow Dividend” portfolio.

Verizon Communications (VZ) ~6.7% Massive yield and essential service (the ultimate high-income foundation).

Chevron Corp (CVX) ~4.6% yield Energy giant with high yield and long history of increasing dividends.

Merck & Co (MRK) ~3.4% yield Rock-solid pharmaceutical giant that funds R&D with strong cash flow.

UnitedHealth Group (UNH) ~2.8% yield Industry leader with strong growth history that fuels its rising dividend.

Nike Inc (NKE) ~2.6% yield Global brand strength that supports a growing payout.

Procter & Gamble (PG) ~2.5% yield The king of consumer staples (Tide, Pampers) meaning dividends through any recession.

Honeywell Intl (HON) ~1.6% yield Industrial tech giant - a stable grower providing essential equipment for the future of automation.

Visa Inc (V) ~0.8% yield Low yield, but its dominant financial network leads to super-fast dividend growth.

Microsoft Corp (MSFT) ~0.7% yield Same as Visa: Low yield, but incredible dividend growth driven by cloud and AI dominance.

Salesforce (CRM) ~0.7% yield A younger dividend payer, but its enterprise software moat ensures massive long-term cash flow and potential price growth.

The Dow Dividend Portfolio

The selected 10 companies have a total 3.43% average yield and 7.14% 5-year dividend growth.

By building your own basket of 10, you get a clean, high-quality, focused portfolio that is simple to manage, tax-efficient, and aligned with your own dividend goals.

So… how did I do? And what portfolio will you make out of these 30 blue-chip superstars?

Until next time, keep walking!

Jeremy ✌️

Disclaimer

This article is for informational and entertainment purposes only. I am not a financial advisor, broker, or tax professional. The information provided reflects my personal opinions and experiences as an individual investor and may not be accurate or current. All investment strategies and investments involve risk of loss. Any ideas presented may not be suitable for all investors and may not take into account your specific investment objectives, financial situation, or needs. Past performance is not indicative of future results. Always conduct your own due diligence and consult with qualified financial professionals before making any investment decisions.