Stock Shopping With "Dividend Achievers"

Power your investment research with over 300 dividend growth companies.

Day 761 | $78,421

Wouldn’t it be great to have a ready-made list of high-quality stocks as a starting point for research?

Instead of spending hours sorting through thousands of options, you could focus on a curated group of reliable companies - kind of like shopping at Costco or Sam’s Club, where they may not have everything, but what’s available offers great value. I recently discovered a group that fits this description perfectly: the Dividend Achievers.

Dividend Achievers are companies that have raised their dividends every year for at least 10 consecutive years.

If You’re New Here… I’m Jeremy!

Nice to meet you! I’m on a journey to financial freedom, and I want to take you along! I’m building an investment portfolio based on high-quality dividend stocks, with the ultimate goal of living off the passive income they generate. Until then, I reinvest all dividends to buy more shares of these great companies, compounding my wealth as I walk towards that goal.

Along the way, I pass on everything I’m learning to give you some fresh ideas! Okay, back to stock shopping…

Why Focus on Dividend Growth?

Dividend growth investing is all about investing in companies that regularly increase their dividends over time.

Why does this matter? Because companies that consistently raise their dividends tend to be financially healthy, have stable cash flows, and operate their businesses responsibly.

Over years, these growing dividends help your investment income keep pace with or even outpace inflation, giving you a steady stream of cash that can grow year after year. Plus, companies that increase dividends regularly tend to be resilient during tough economic times, which makes them good long-term investments.

How to Find Top Dividend Growth Companies

With over 4,000 stocks in the US alone, it’s hard to know where to look. Much less, narrow your focus to the best companies.

Dividend Achievers are companies that have raised their dividends every year for at least 10 consecutive years. This focus on steady dividend growth helps identify businesses that prioritize rewarding their shareholders.

These companies are diverse and cover virtually every sector—think technology, healthcare, finance, real estate, and more - and they form a large universe of over 300 companies.

Unlike some other dividend groups that are very exclusive, Achievers include newer dividend growers along with well-established ones, giving you a broader pool to consider.

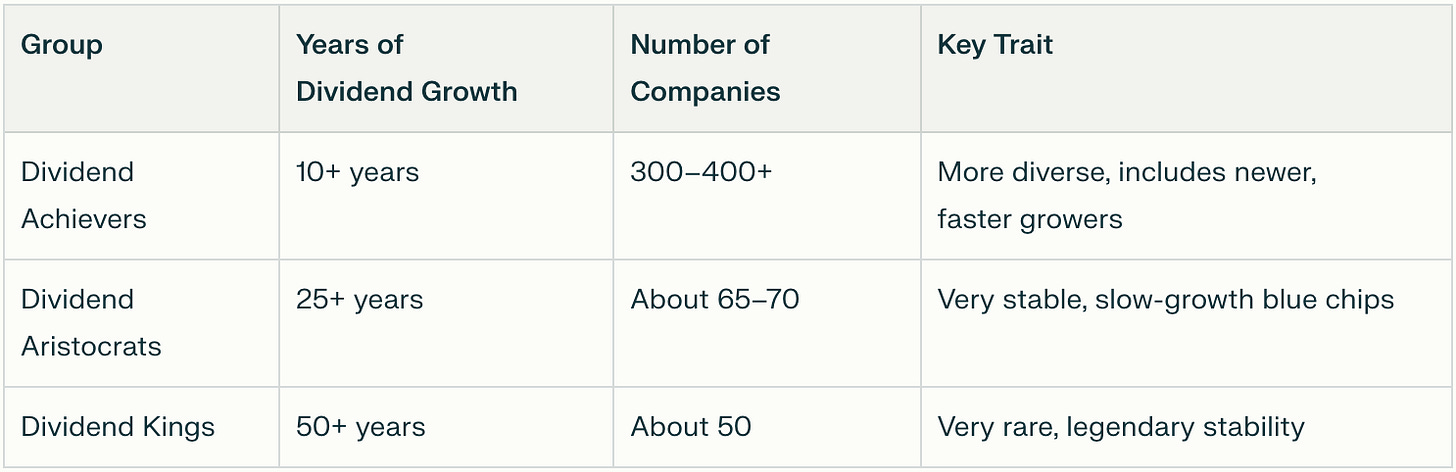

How Do They Compare to Aristocrats and Kings?

Dividend Aristocrats and Kings are popular groups of stocks known for their exceptional stability. Aristocrats are companies that have grown there dividends for 25+ years and Kings boast over 50+ years of growth.

On the surface, this may sound like a better starting point, but these elite groups often cover fewer companies and tend to be in slower-growth sectors like consumer staples. It makes sense if you think about… Once you hit 50+ years of growth, its hard to keep the streak alive so a lot of these companies raise their dividends just enough to stay on the list.

Dividend Achievers, on the other hand, include companies that may be younger but are still committed to increasing dividends - a good mix for growth and income.

Why are Dividend Achievers a Great Starting Point?

Fresh Opportunities: Many Achievers are growing their dividends at a faster pace than the long-time aristocrats or kings.

More Sector Diversity: Unlike Aristocrats and Kings, which are often concentrated in certain sectors, Achievers span across technology, healthcare, finance, real estate, and more.

Potential for Higher Total Returns: These companies can provide both rising income and capital appreciation, making your investment grow from multiple angles.

Meet PFM, the Dividend Achiever ETF

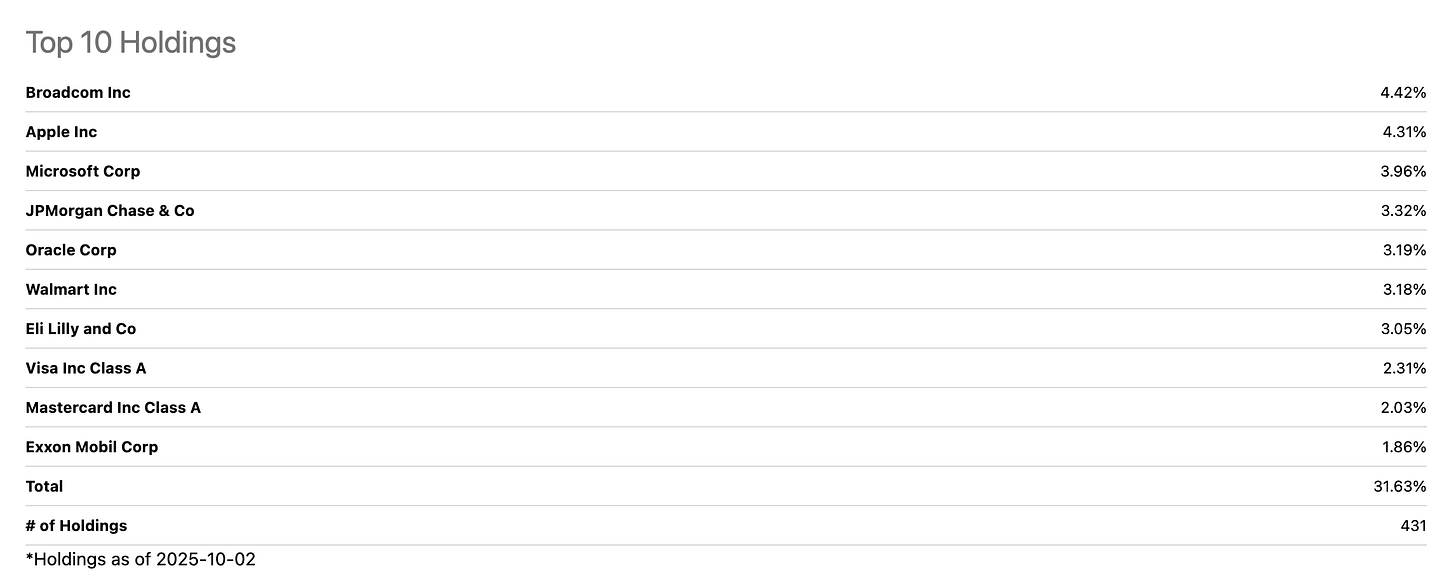

One easy way to invest in these companies is through the Invesco Dividend Achievers ETF (Ticker: PFM). This fund tracks an index of companies that have increased dividends for at least 10 years. Today, it includes over 300 holdings, with big names like Apple, Microsoft, and JPMorgan Chase.

Over the past decade, this ETF has delivered strong returns - around 12% per year - while steadily increasing its dividends.

While those returns are stellar, some companies in the Achiever’s list are dragging down the fund’s dividend growth. The last decade’s dividend growth is 4.36% and the last 3 years is actually showing negative growth at -0.51%.

Why Picking Stocks May Be Better

Buying just the ETF is simple, but it can include companies that aren’t your top choice. Picking individual stocks from the Achievers list allows you to:

Avoid management fees or expense ratios (PFM has a 0.52% fee, which is higher than what I like especially compared to one of my favorite ETFs, SCHD, which is only 0.06%)

Focus on companies with higher yields or faster growth (As discussed, the average dividend growth for all Achievers has dragged recently)

Customize your portfolio to match your goals and risk tolerance

Four Inspiring Dividend Achievers

Let’s look at a few individual companies to see how they stack up. Here’s a quick intro to four stocks that exemplify what Dividend Achievers are about:

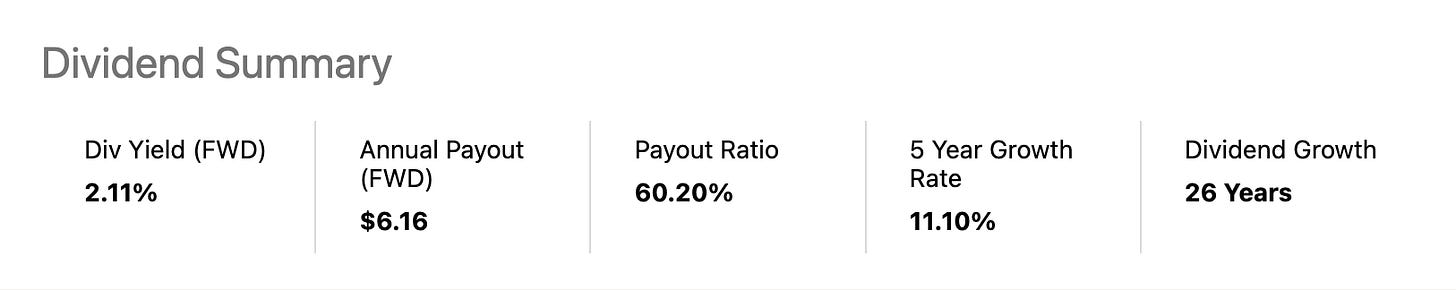

1. ADP (Automatic Data Processing)

A global leader in payroll and HR services, ADP helps businesses manage employee data and payroll. Chances are, your paycheck is made possible thanks to ADP! It pays a dividend yield of about 2.11%, with dividends increasing roughly 12% annually over the past decade. Its payout ratio is about 60%, showing it balances growth with dividend safety.

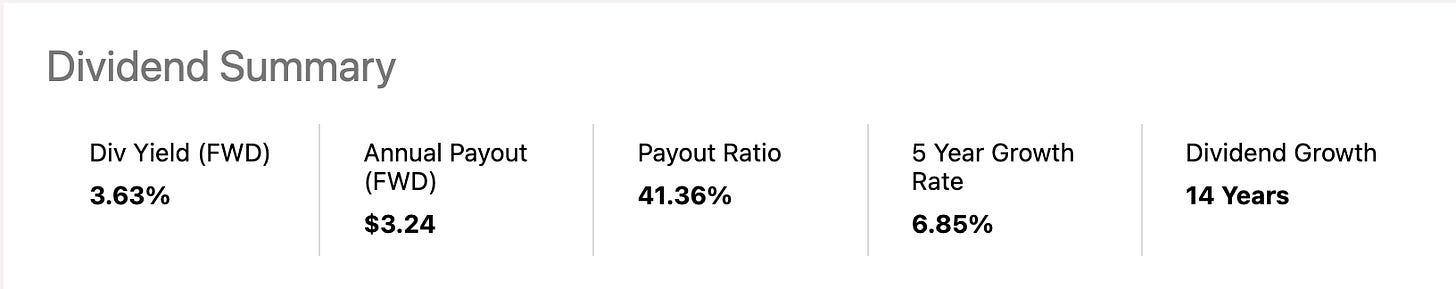

2. MRK (Merck & Co.)

A major pharmaceutical company that makes medicines, vaccines, and healthcare products for humans and animals. Merck offers a dividend yield of around 3.63%, with over a 6% dividend growth rate in the last 10 years, and a payout ratio of about 40%, providing both income and stability.

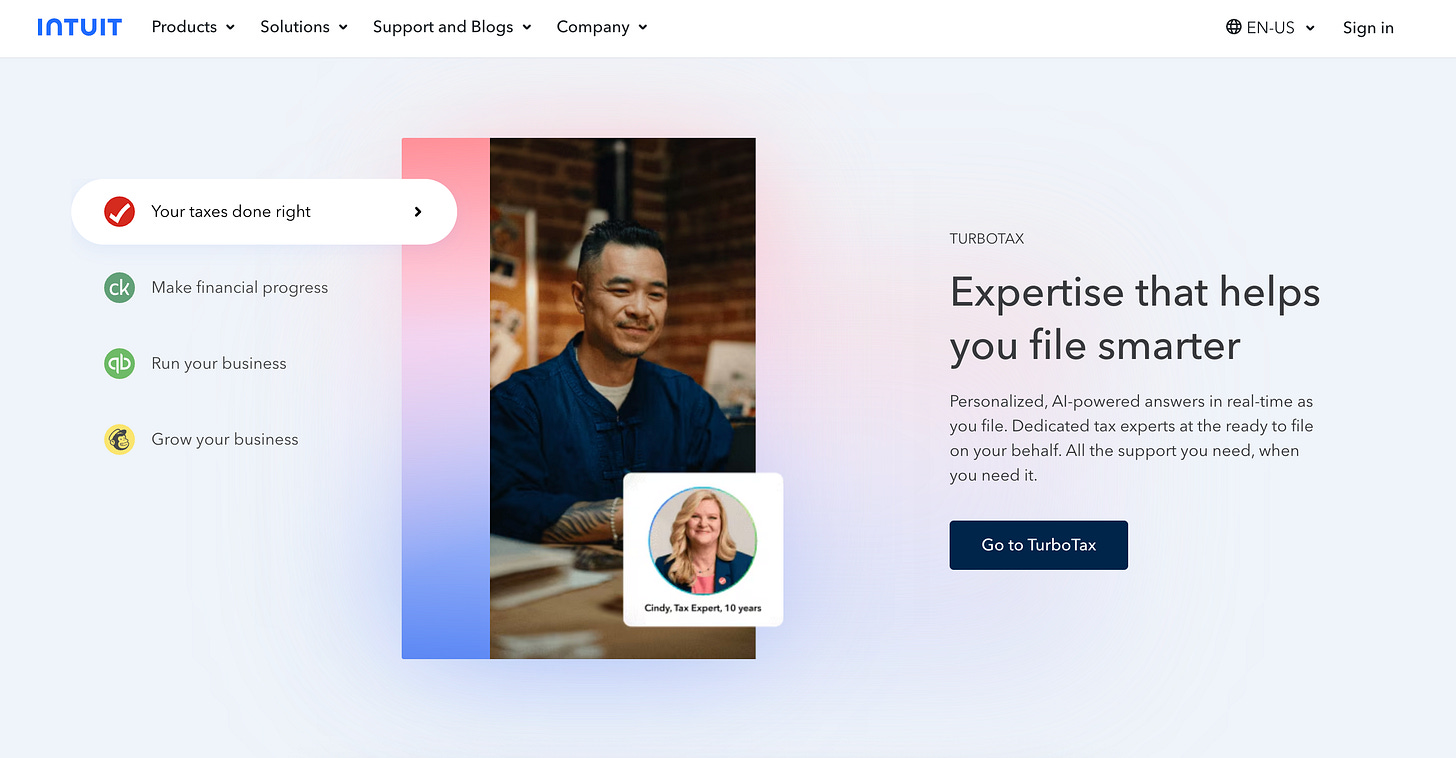

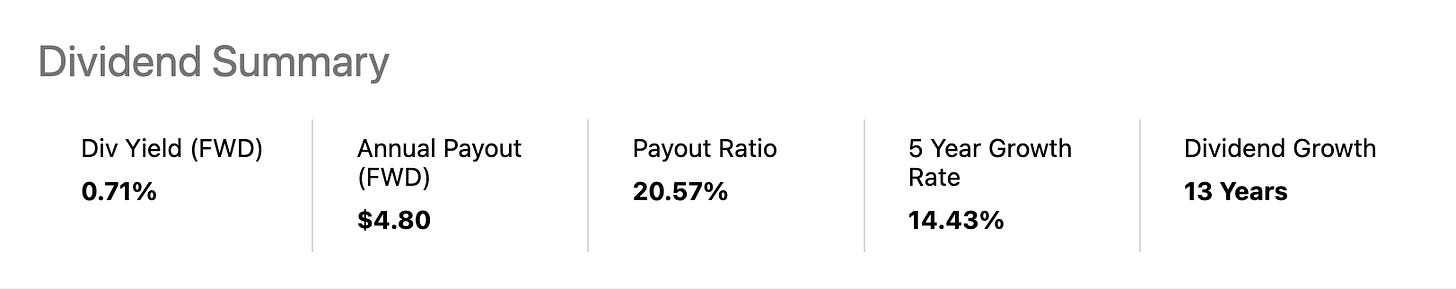

3. INTU (Intuit)

Known for financial software like QuickBooks and TurboTax, Intuit has a lower yield of about 0.70%, but it has grown dividends at a rate of 15% annually over the past decade. It maintains an extremely low payout ratio around 20%, suitable for investors seeking more growth.

4. ACN (Accenture)

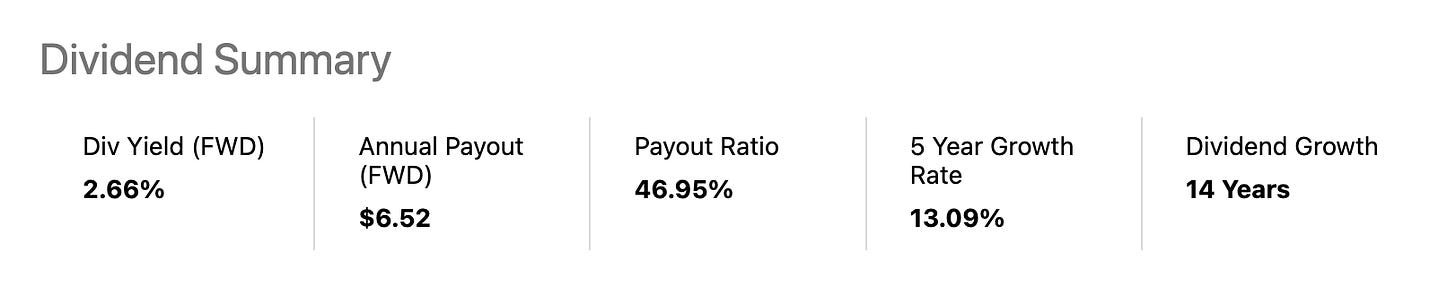

A global consulting and tech services company that helps businesses with digital transformation. It offers a dividend yield of roughly 2.6%, with a dividend growth rate of over 13%, and a payout ratio of under 50%.

These are 4 companies I have on my watchlist as all look to be fairly valued, if not undervalued and offer a great mix of current dividend yield and future growth.

What About The Risks?

Unfortunately, there’s no free lunch when it comes to investing.

Even though these companies have grown dividends for at least ten years, that’s no guarantee it will continue forever. Difficult times can cause even the most reliable companies to pause or reduce dividends. Plus, like any stock, Achievers can be affected by market swings and interest rate changes. It’s important to understand that no investment is risk-free, especially in the stock market.

Ready To Go Shopping?

Starting with the Dividend Achievers list puts you in front of the “Costco” shelf of proven companies: a pre-vetted group delivering value, reliability, and often, both yield and long-term compounding. While ETFs like PFM make it simple to access this universe, doing your own stock research can help you build a more tailored, cost-efficient portfolio—one that balances income and growth over the long term.

What Dividend Achievers do you have on your watchlist? Let us know in the comments below!

Until next time, keep walking!

Jeremy ✌️

Disclaimer

This article is for informational and entertainment purposes only. I am not a financial advisor, broker, or tax professional. The information provided reflects my personal opinions and experiences as an individual investor and may not be accurate or current. All investment strategies and investments involve risk of loss. Any ideas presented may not be suitable for all investors and may not take into account your specific investment objectives, financial situation, or needs. Past performance is not indicative of future results. Always conduct your own due diligence and consult with qualified financial professionals before making any investment decisions.