Know What You Own: Unpacking Alphabet (GOOGL) – Beyond the Search Bar

Welcome to the First Post in my “Know What You Own” Series!

If you’re new here, I’m a full-time designer sharing my journey to financial freedom through dividend investing. While I love sharing my personal experience, I’m not a financial advisor or expert so do you own research and due diligence before making any investments. Consider this a fun, entertaining read!

Let’s dive in!

Peter Lynch, the legendary fund manager who ran Fidelity’s Magellan Fund from 1977 to 1990, believes that ordinary people can outperform professional investors.

His secret? Stick to what you know.

Lynch argues that everyday folks (like you and me) can spot great companies in our daily lives – from the products we use to the services we rely on – long before Wall Street catches on. That coffee shop you can’t stop visiting? That app your kids are obsessed with? These real-world observations can be an open door to building lasting wealth.

By understanding the businesses behind the stocks, rather than just chasing trends or numbers, investors can make smarter, more confident decisions. This “know what you own” approach turned Magellan into a powerhouse, delivering jaw-dropping annual returns of 29% during his tenure.

Inspired by Lynch, I’m launching this series to break down the companies in my own dividend portfolio. I hold around 25 stocks, focusing on quality businesses with strong moats and growth potential.

Alphabet Inc. (GOOGL), the parent of Google, makes up 7% of it – my second-largest position.

Why Start with Google?

Honestly, it’s a fun one! From searching for your next vacation spot to self-driving cars taking over cities like Phoenix, Alphabet touches so much of our modern life.

Plus, as a tech giant evolving into a dividend payer, Google shows how even “growth” stocks can fit a long-term, dividend investor’s plan.

Oh yeah, Google has also crushed the market over the last 10 years.

Let’s unpack it as of mid-October 2025, covering its dividend path, moat, and risks.

Part 1: The Dividend Story – From Fast Growth to Steady Income

I focus on dividends in my portfolio, and Alphabet takes up about 7% of it - which may be surprising as tech companies usually spend all their money on growth, not dividend payouts.

But in 2024, Alphabet started a quarterly dividend and I saw this as an opportunity to add some growth to the mix. As of October 2025, the yield is around 0.35%. I know, I know - that’s low! Not anywhere close to the type of income you can retire on, but hear me out…

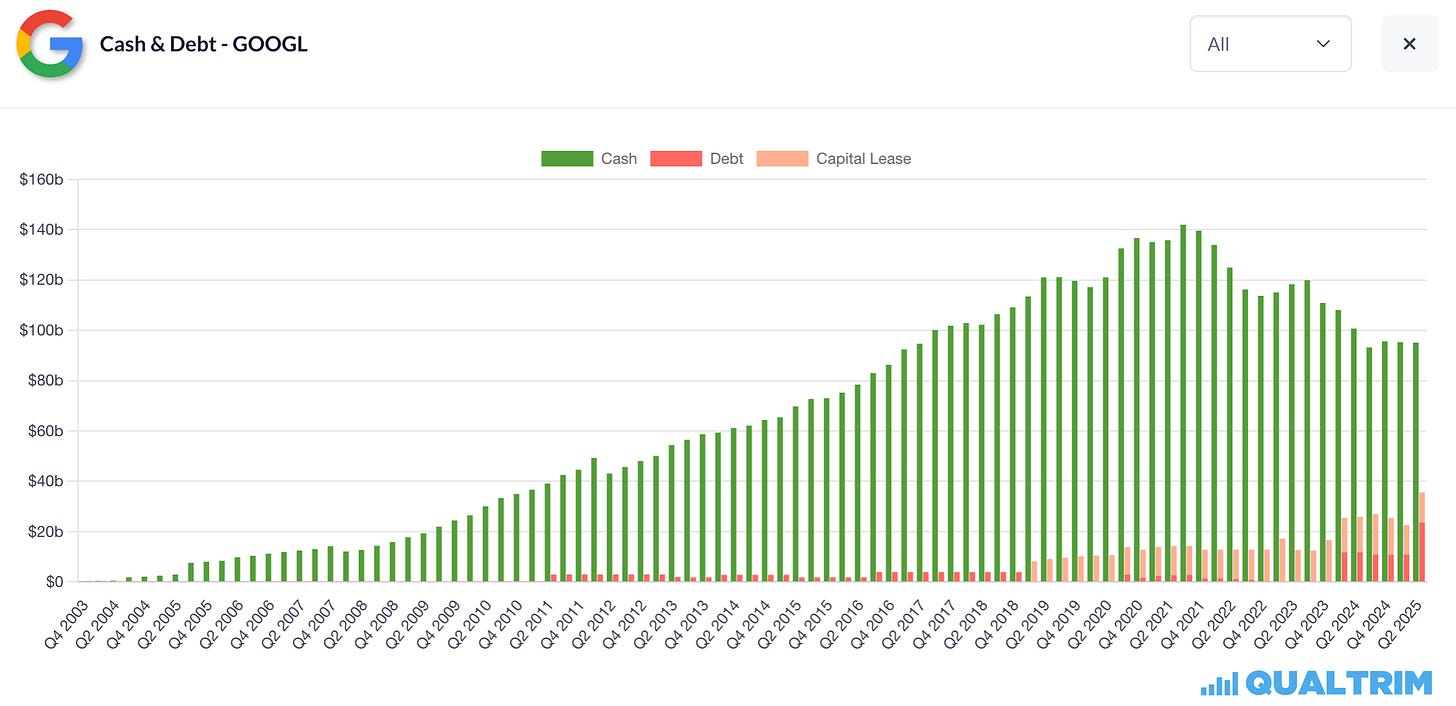

The recent dividend hike was also a let down at just 5%, but when we take a deeper look, we can see some huge dividend potential. The payout ratio – how much of earnings goes to dividends – is only about 7.5% of adjusted earnings and 15% of free cash flow. That’s tiny compared to older companies in my portfolio like Procter & Gamble and Target (around 60%).

Google’s tiny dividend means two things:

Strong Safety: The dividend is unlikely to get cut, even in tough times.

Room to Grow: With over $80 billion in yearly free cash flow, they can raise dividends by 20-30% each year without cutting back on investments.

In the end, I own Alphabet for its mix of stock price growth (up 25% so far in 2025) and future dividends. It’s like a young version of a reliable dividend stock.

Part 2: Breaking Down the Moat – Why Alphabet Stays Ahead

Uncle Lynch likes simple businesses, but Alphabet (like many other tech giants) has a ton of layers. Its moat comes from huge size, special data, and products that work together.

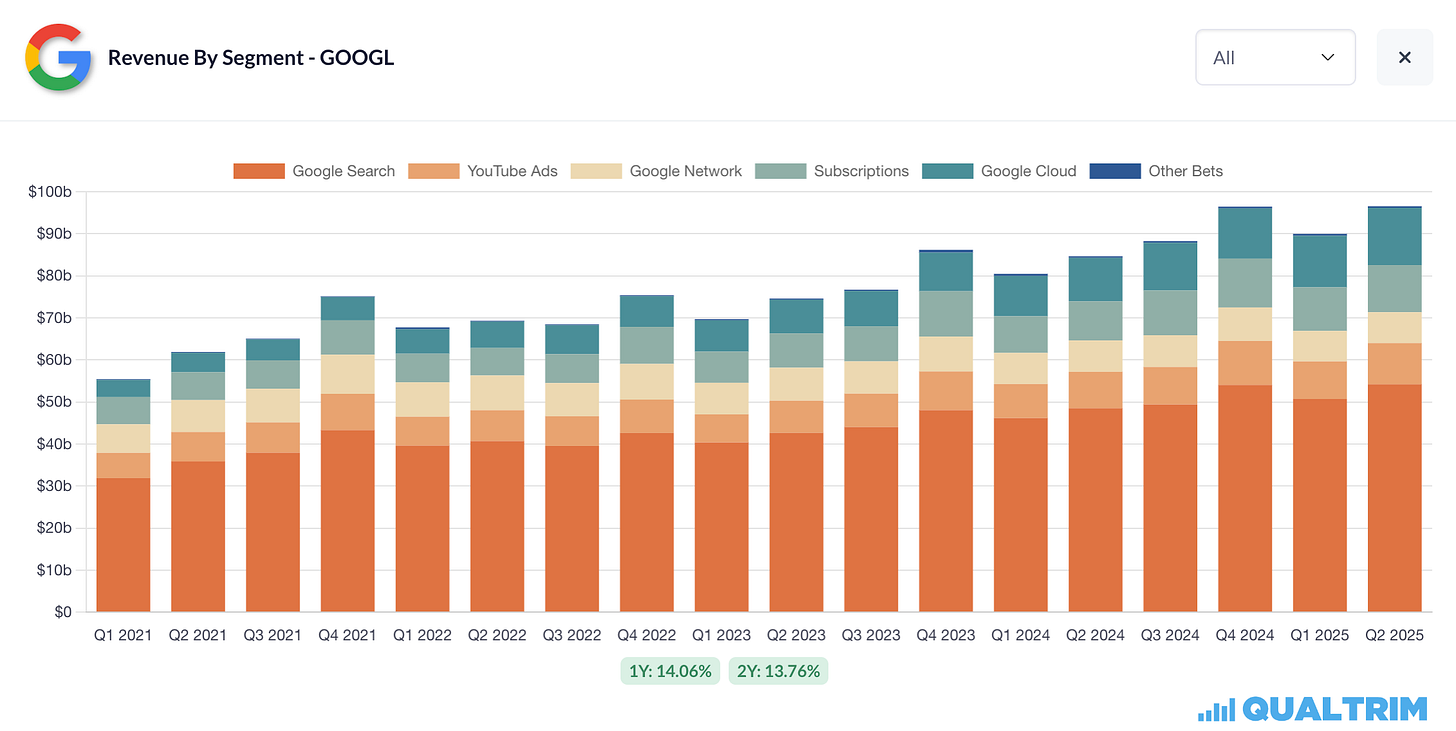

Before peeling back those layers, here’s a quick big-picture view of its revenue segments. Aka - How Google makes money.

Google earns revenue from each of these segments. Here’s a look at the Q2 2025 figures (in billions) with year-over-year growth:

Google Search: $54.2 (up 12%) – Ads from search results and other Google properties like Maps and Gmail.

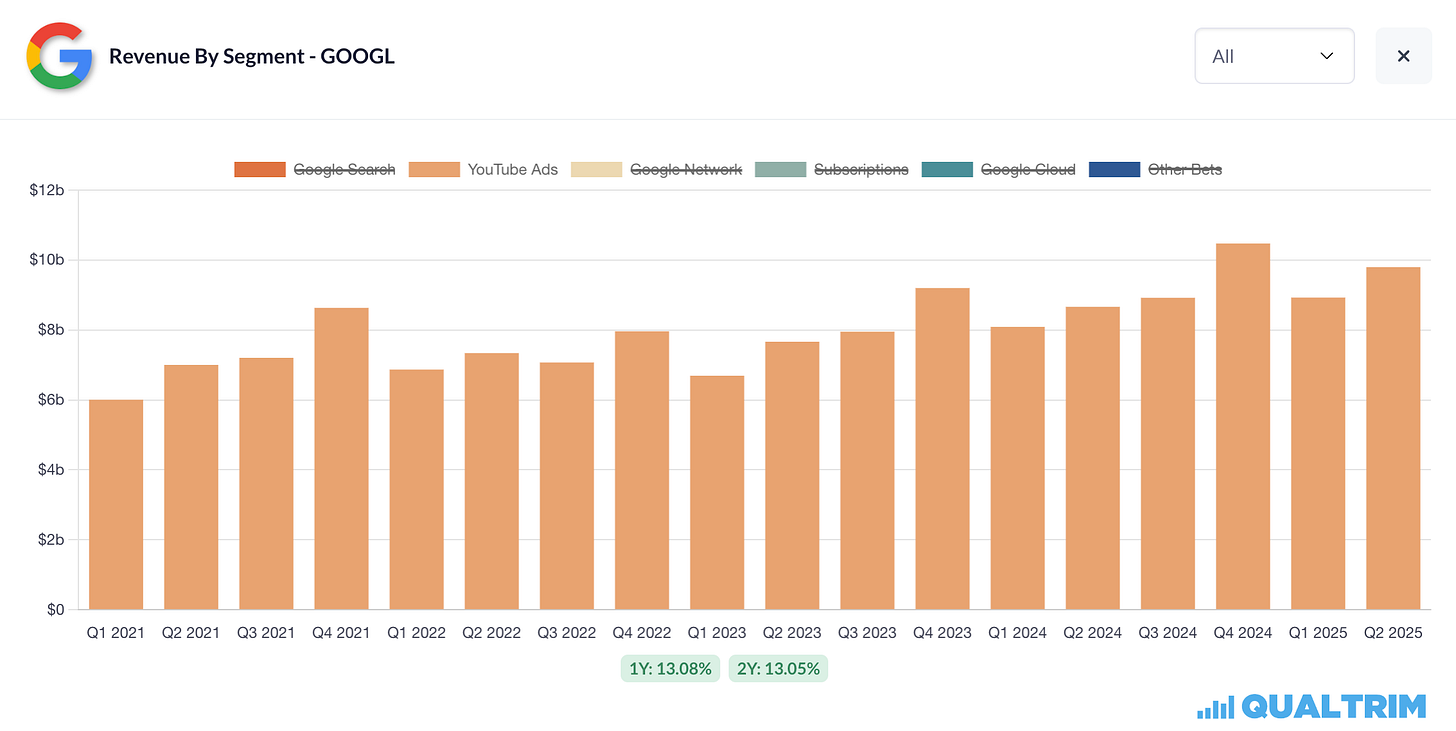

YouTube Ads: $9.8 (up 13%) – Advertising on YouTube videos and Shorts.

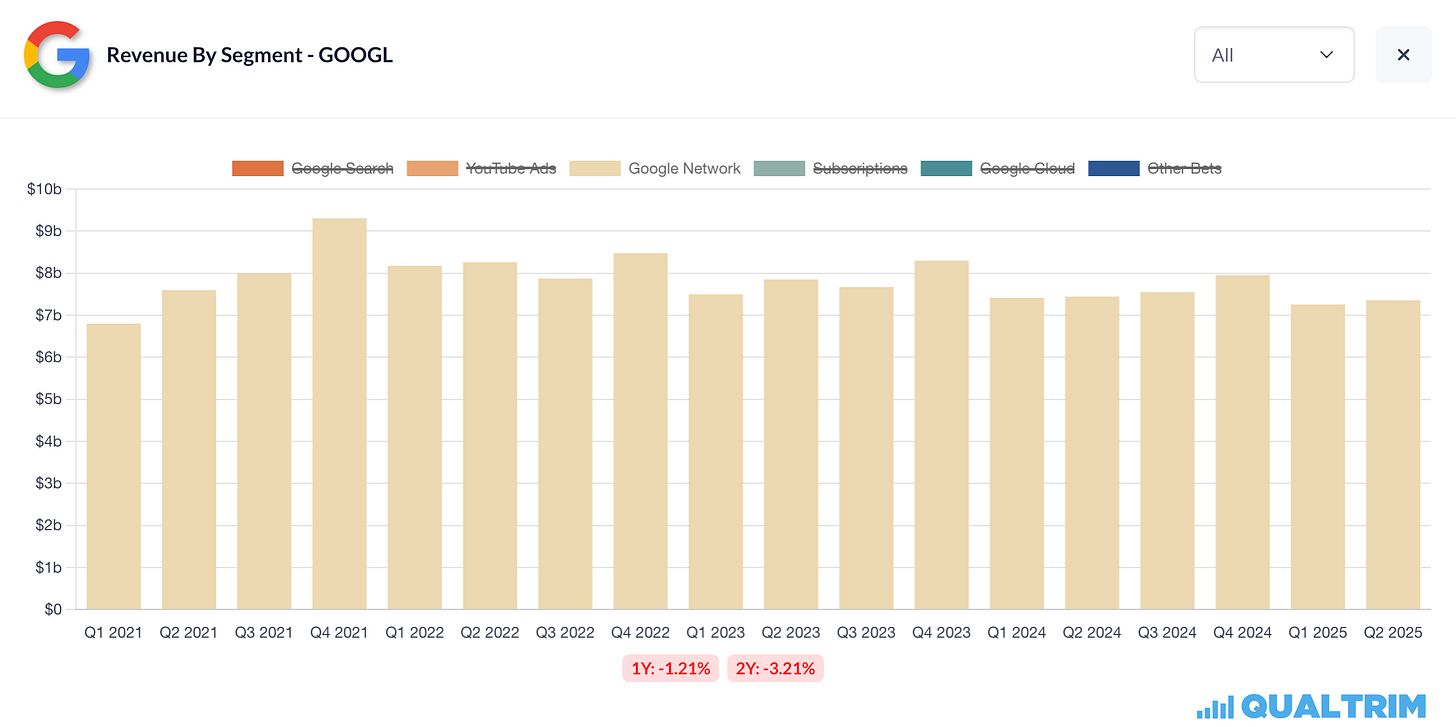

Google Network: $7.4 (down 1%) – Ads served on partner websites through programs like AdSense.

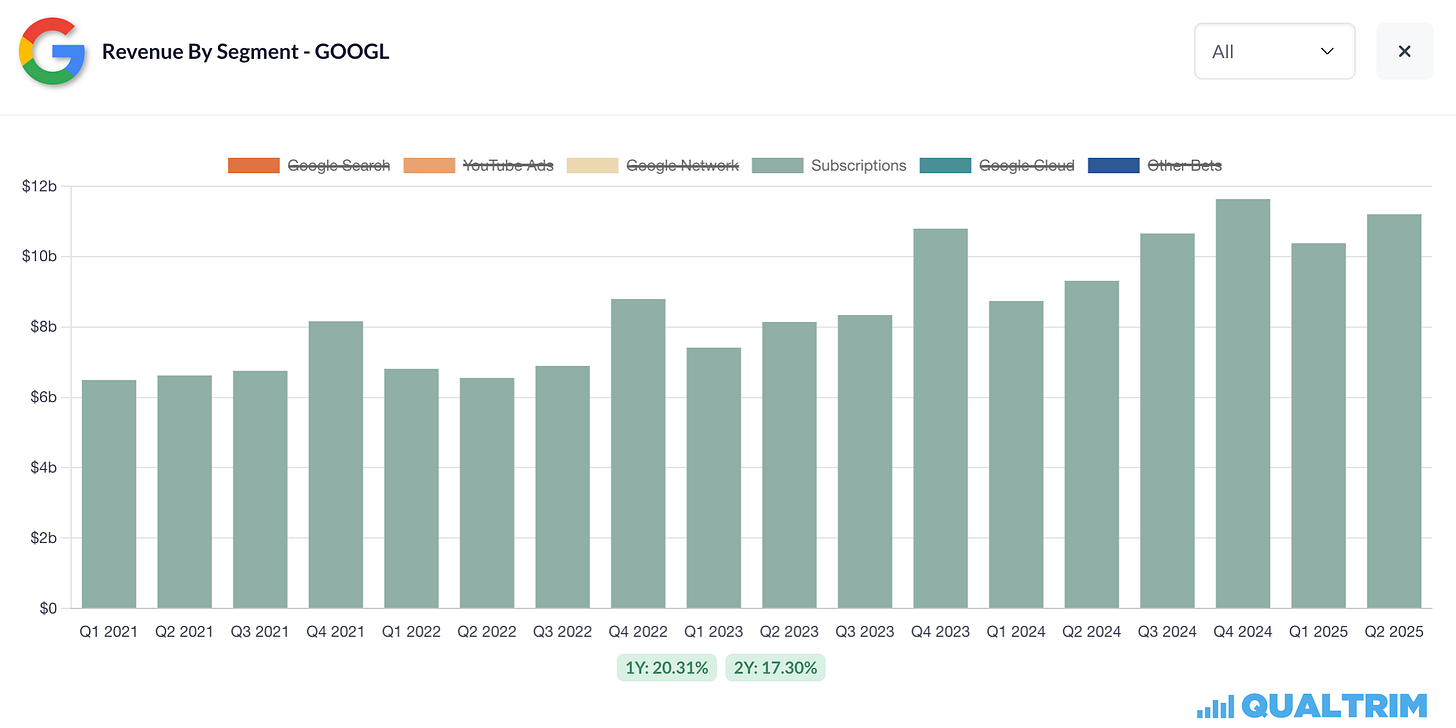

Subscriptions: $11.2 (up 20%) – Recurring revenue from YouTube Premium/Music, Google One storage, app store fees, Pixel devices, and AI chat bots like Gemini.

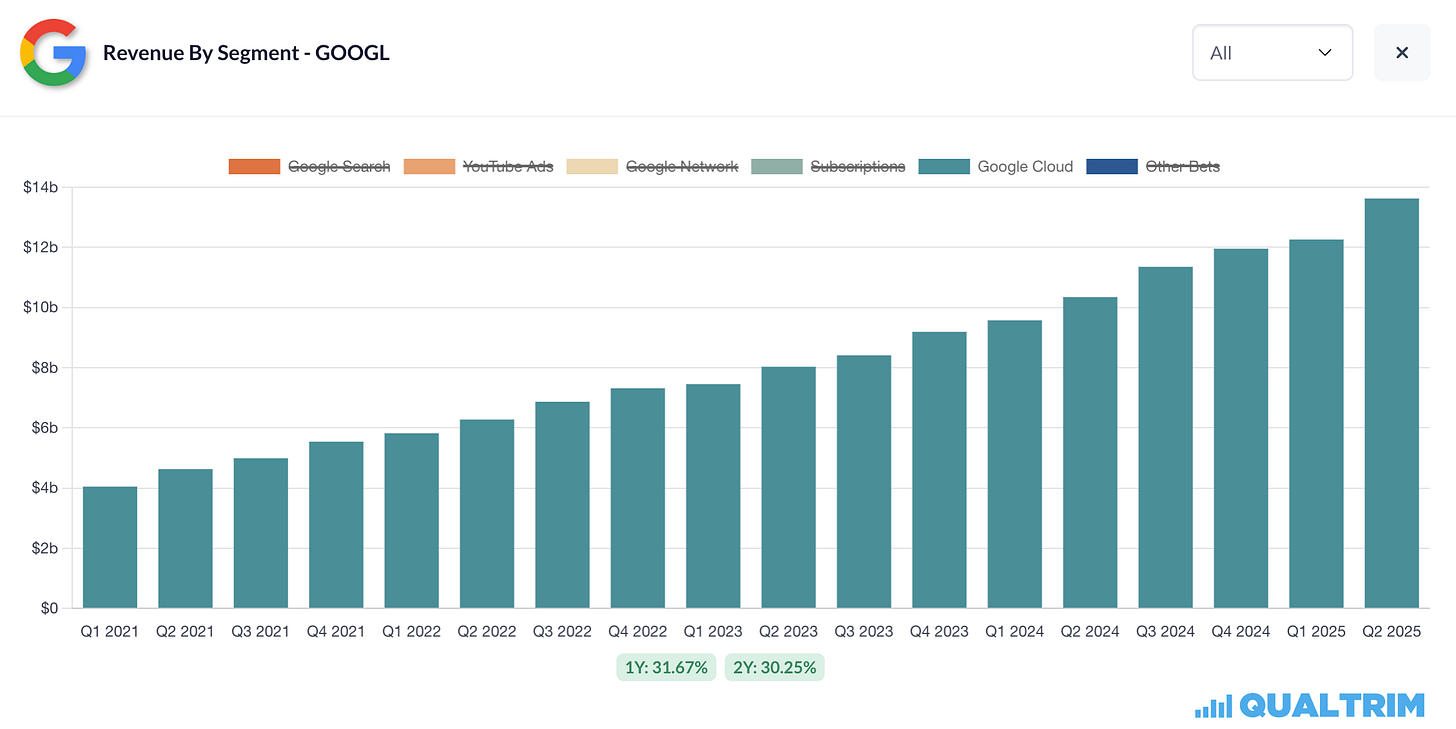

Google Cloud: $13.6 (up 32%) – Cloud computing and AI services.

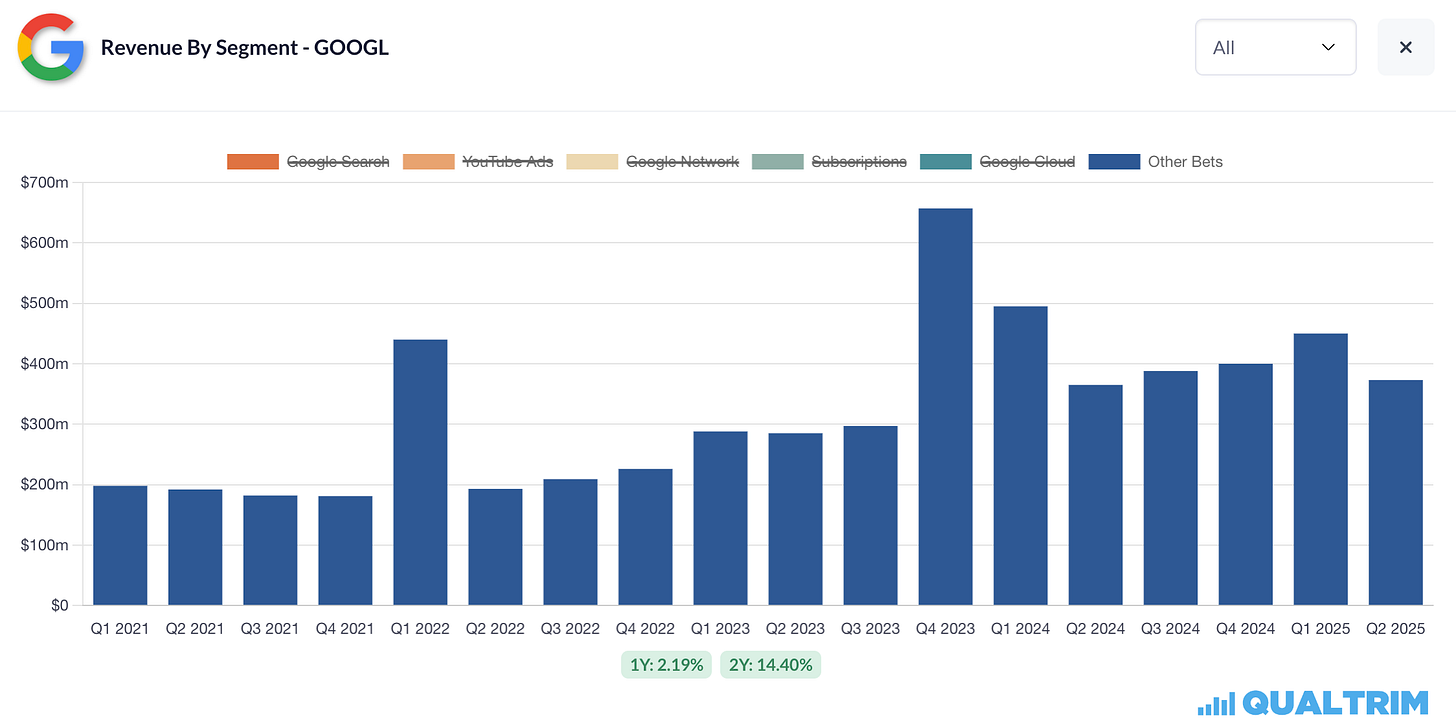

Other Bets: $0.4 (up 2%) – Experimental ventures like Waymo and Verily.

Overall, Alphabet’s total revenue hit $96.4 billion in Q2 2025, up 14% from the prior year (source).

Now, let’s zoom in on the key strengths within these areas.

Google’s Money Makers

Google Search: The Mothership

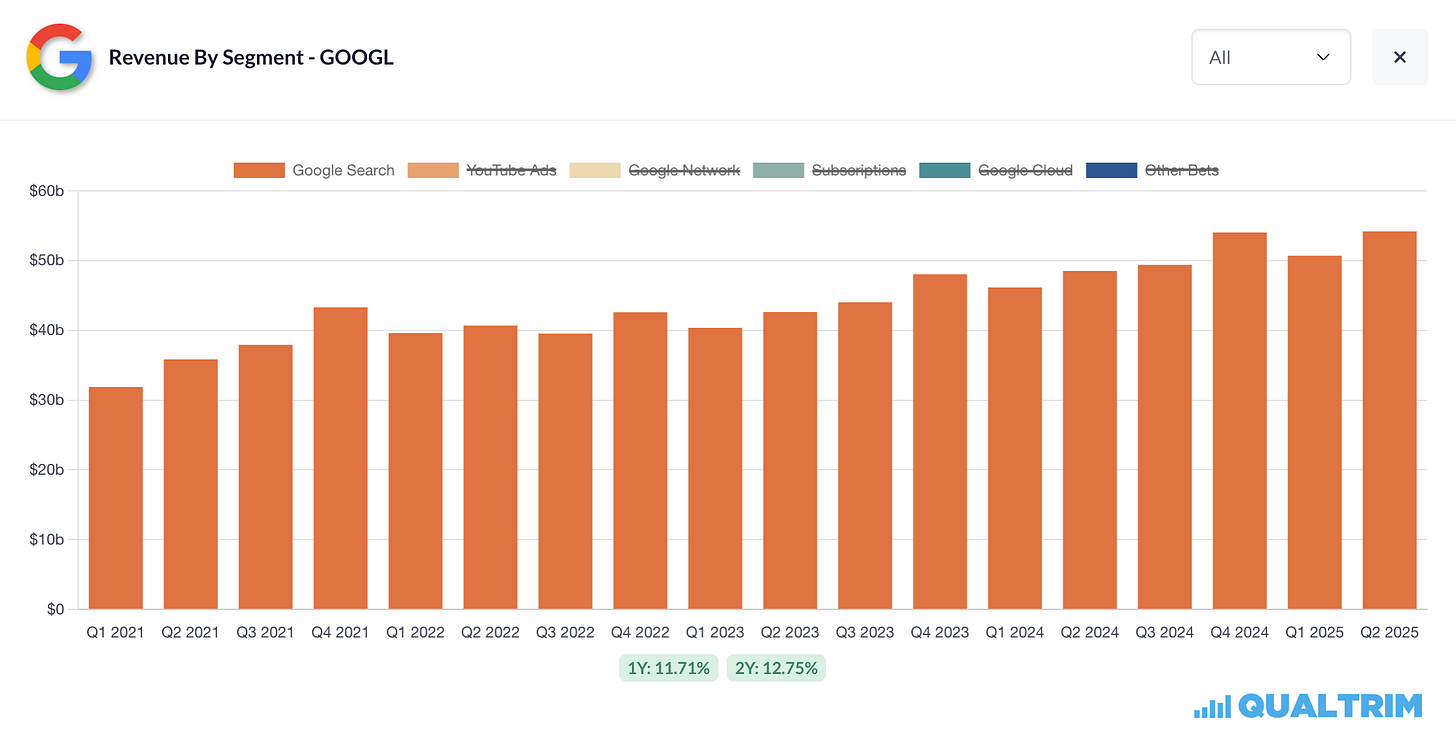

You probably know Google for search. Just “Google” it, right? Lately there’s been a new verb in town, “ChatGPT it”. With all the popularity you may not realize that Google is still quietly growing their own AI chat services, Gemini. And Google’s search still holds 90% of the global market as of September 2025.

It’s slipped a bit but still rules. Why? More users mean better data, which improves results and draws more ads. This segment, which includes ads on Search and other sites like Maps and Gmail, brought in $54.2 billion in Q2 2025 - profits that pay for other areas.

YouTube Ads: A Huge Video Leader

YouTube often gets overlooked, but it’s massive. It has 2.5 to 2.7 billion users each month. That’s way more than Netflix’s 300 million paid users. This ad revenue stream hit $9.8 billion in Q2 2025, up 13%!

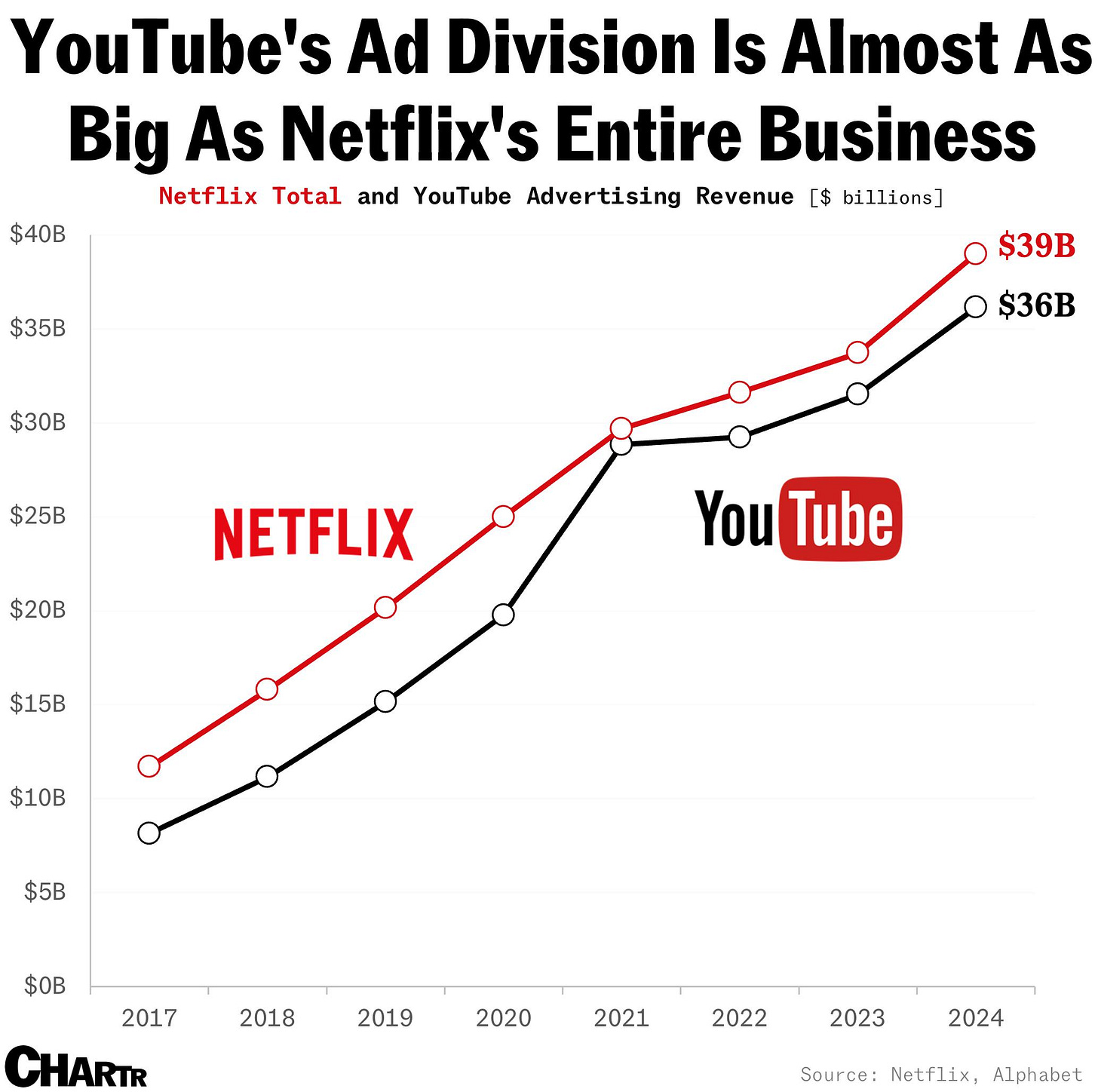

In fact, YouTube’s advertising revenue is almost as high as Netflix’s entire business!

Does Google have a secret advantage or something? I think so! Endless free content from users, plus smart suggestions that keep people watching longer than on other sites.

Google Network: The Partner Ad Engine

This segment generates revenue from ads placed on third-party websites and apps through Google’s network, like AdSense for publishers. It earned $7.4 billion in Q2 2025, though down slightly 1% year-over-year. I believe this is where Google is seeing the consumer shift from tradition search to AI.

The moat here is Alphabet’s vast ecosystem of publishers and advertisers, powered by advanced targeting that matches ads efficiently.

While growth is slower than other areas, it provides stable, diversified ad income. I mean, you can’t win them all, right?

Subscriptions: The Recurring Revenue Stream

This segment includes subscription services like YouTube Premium and Music, Google One (cloud storage), Gemini, Play Pass, and revenue from hardware sales like Pixel phones and Nest devices, plus app store commissions. It grew strongly to $11.2 billion in Q2 2025, up 20%

The advantage: High-margin recurring fees create sticky user loyalty within the Google ecosystem, turning one-time users into ongoing payers.

Personally, I backup all my computer files on a paid Google Drive plan, but I started with the free tier. Sure, I only pay a few bucks a month, but I’m getting close to hitting the next tier. Multiple this over millions of users, and you have some steady revenue coming in month after month.

Google Cloud: The Growth Side

Think about how much content AI has added to the digital world in recent years. Not to mention how much more reasoning these large language models required. That digital space has to live somewhere. And that somewhere is massive servers sitting in high-tech data centers.

Google Cloud (GCP) is third largest behind AWS (Amazon) and Azure (Microsoft), but it’s catching up. In Q2 2025, it made $13.6 billion, up 32% from last year – faster growth than AWS (18%) and Azure (28%).

GCP stands out with special chips made for AI. Plus, built-in developer tools making it hard for customers to leave.

Gemini, Alphabet’s advanced AI model, drives revenue across Subscriptions and Google Cloud. For consumers, Gemini Advanced is bundled into Google One subscriptions, boosting that segment’s growth with premium features like smarter assistants and content creation. In enterprise, Gemini powers Google Cloud’s generative AI tools, helping businesses build custom apps and analyze data – a key reason for Cloud’s 32% jump.

Side note: The other day, my 4-year old asked me what kind of bug landed on the trampoline. When I told him I wasn’t sure, he quickly responded with, “Ask Gemini.”

As of mid-2025, Gemini reaches 450 million users monthly, integrated into Search for quick answers and Workspace for productivity. This AI edge strengthens Alphabet’s moat, turning data into innovative services while countering rivals like ChatGPT.

Other Bets: Waymo and More

When it comes to self-driving cars, most of us think of Tesla first - thanks to their incredibly brilliant (and outspoken) leader, Elon Musk. But once again, Google is quietly dominating in the background.

Waymo completes roughly 250,000 trips per week—averaging 24-30 trips per vehicle per day, which demonstrates significant reliability (source).

Tesla’s pilot robo taxi program in Austin reported 7,000 total miles covered across all vehicles in its first month, translating to less than 20 miles per vehicle per day, with far fewer daily rides per car (source).

So yeah, Waymo is taking some serious action.

This segment, including health tech (Verily) and drones (Wing), generated $0.4 billion in Q2 2025.

While small, these bets leverage Alphabet’s data edge for future growth. Alphabet’s moat – big scale, private data, and linked products – is wide. Copying it would cost a fortune.

Part 3: Solid Finances and Key Risks

Alphabet has a strong balance sheet: $95 billion in cash and low debt. It makes over $80 billion in free cash flow yearly. This covers big AI spending ($50 billion in 2025) and new dividends.

But Risks Exist:

Government Regulation: Big tech companies like Google are always under the microscope. In August 2024, a U.S. judge ruled Google illegally monopolized search. But in September 2025 remedies, Google won big - The court rejected DOJ’s calls for divesting Android or Chrome, saying it could hurt consumers, innovation, and partners (source). Google is never out of the woods as EU and global probes persist.

AI Changing Search: I think this is the big one - New AI like chatbots could replace how people search. ChatGPT has 800 million weekly users, and young people often use AI instead of Google. But Google’s share is still 90%, and Gemini reaches 450 million users monthly, although much smaller than ChatGPT.

High Spending: While Google does hold a lot of cash, building for AI and cloud costs a lot, which can slow profits short-term. Google has to keep pushing innovation to keep their lead.

Do You Know What You Own?

This isn’t just a search engine company. It’s an interconnected system of dominant platforms, cutting-edge AI, vast data, cloud infrastructure, and moonshot projects – all backed by fortress-like finances and the best talent in the industry.

Should You Buy?

Morningstar rates Alphabet with 3 out of 5 stars, indicating it’s fairly valued, with an estimate of $237 per share, a wide economic moat, and medium uncertainty.

For me? I’m technically buying Google every single week – but that’s because I dollar-cost average into all my portfolio stocks consistently. As a long-term investor, I’m not trying to time the market or catch the perfect entry point. I’m focused on steadily building positions in high-quality businesses that I understand and believe will compound value over decades.

Whether Alphabet belongs in your portfolio depends on your goals, risk tolerance, and timeline. But hopefully, now you know exactly what you’d be owning!

Let me know in the comments what you think about this type of article. Do you own or plan to own Google?

Until next time, keep walking!

Jeremy ✌️

Disclaimer

This article is for informational and entertainment purposes only. I am not a financial advisor, broker, or tax professional. The information provided reflects my personal opinions and experiences as an individual investor and may not be accurate or current. All investment strategies and investments involve risk of loss. Any ideas presented may not be suitable for all investors and may not take into account your specific investment objectives, financial situation, or needs. Past performance is not indicative of future results. Always conduct your own due diligence and consult with qualified financial professionals before making any investment decisions.

This "Know What You Own" series is exactly what the investment community needs more of - Peter Lynch inspired fundamental analysis presented accessibly. Your segment-by-segment breakdown makes Alphabet feel less like an inscrutable tech giant and more like a collection of understandable competitive advantages. The Waymo data point is incrediby striking - 250k trips/week vs Tesla's pilot program doing less than 20 miles/vehicle/day shows execution gap, not just narrative. Most investors miss this because Elon dominates mindshare. The YouTube revenue comparison to Netflix is also eye-opening. GOOG pulling $9.8B in YouTube ads (Q2) vs Netflix's entire business model highlights how underappreciated YouTube's monetization is. Your point about the 7.5% payout ratio creating both safety and explosive growth potential resonates - essentially buying a growth compounder with a dividend floor. The regulatory risk section feels balanced. The September 2025 ruling rejecting Android/Chrome divestiture was huge, but you're right that EU scrutiny persists. On AI disruption: Gemini's 450M monthly users vs ChatGPT's 800M weekly is closer than headlines suggest, especially given Google's distribution advantage through Search/Workspace. Looking forward to the next deep dive in this series!