Introducing the Wealth Walk App!

Tracking My Real-Time Dividend Portfolio!

I’m excited to share my latest AI project, Wealth Walk—a real-time portfolio tracker designed to let you follow every move of my investment journey. Every business day, I invest into 8 hand-selected dividend growth and covered call ETFs, and you can see every dollar and milestone in action at wealthwalk.app.

Wealth Walk is built on my signature strategy: pairing the steady paychecks of dividend growth investing with the pay boosts of covered call ETFs. The goal? Document my progress toward financial independence - and help spark your own journey!

Note: for those interested, I built this with Bolt and am currently powering the data with Google Sheets and the SheetsFinance extension. It may take a few seconds to load.

Let’s Take an App Walkthrough

Dividend Income Counter: Celebrate Fun Milestones

Watch the dividend income grow - and see when it hits fun, motivational milestones like covering a Starbucks coffee, a car payment, a mortgage, all the way up to work-optional income. Each marker is a reminder of how steady progress adds up.

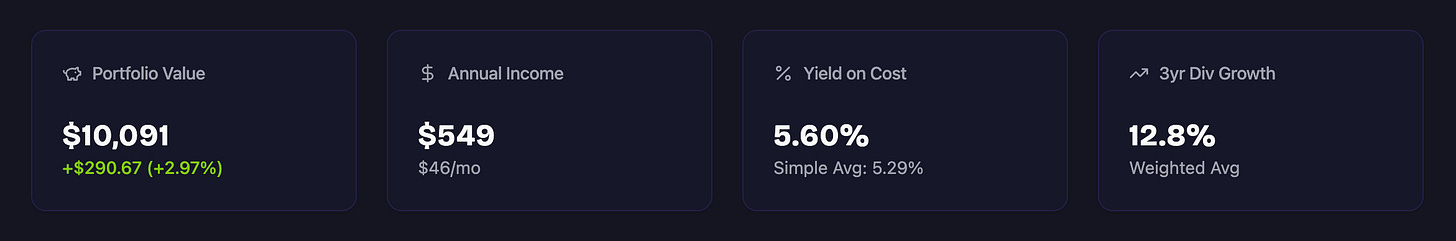

Portfolio Metrics: Dashboard at a Glance

Portfolio Value: Real-time total value, with daily and all-time gains.

Annual Income: My current projected yearly dividend total with a monthly breakdown.

Yield on Cost: My true yield based on dollars invested - proof of the dividend-growth “pay raise.”

3-Year Dividend Growth: The average annual pace my dividends have grown over the last three years - fuel for real wealth-building.

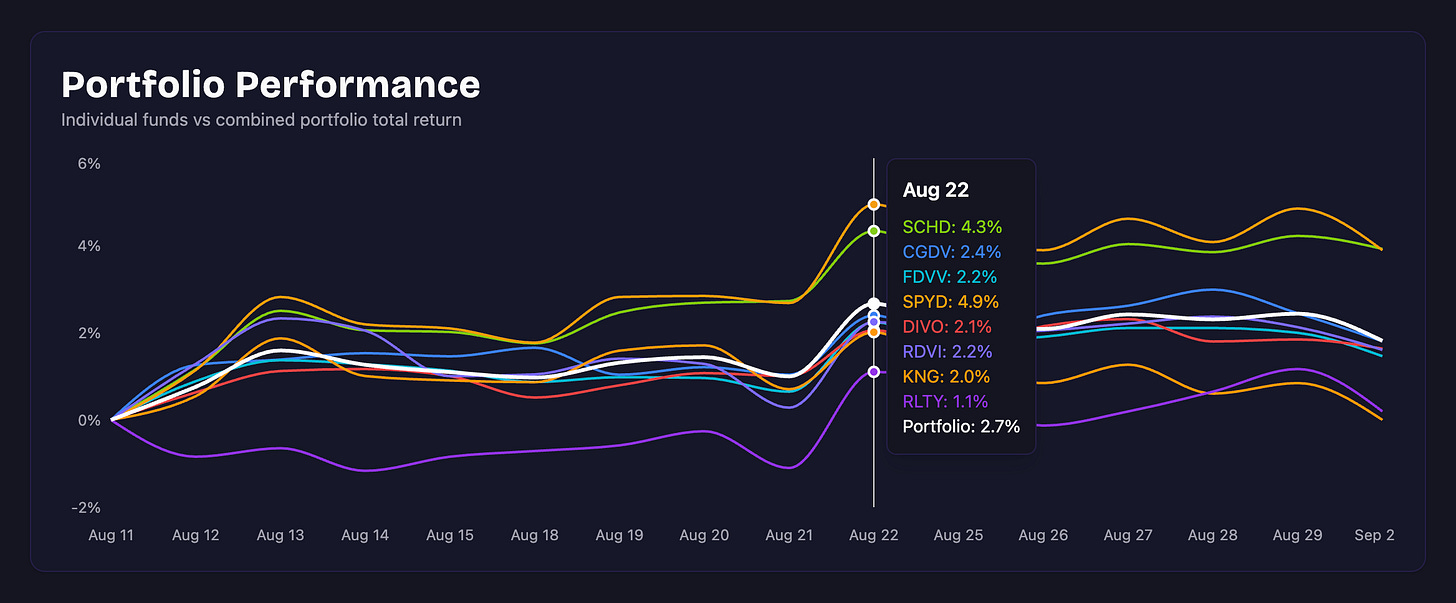

Portfolio Performance Chart: Visualize Progress

See how each fund stacks up to the overall portfolio. This chart brings the journey to life, showing how compounding, market swings shape long-term results.

Top Individual Holdings: The Real Engine

Possibly the coolest part: this section breaks down the top 35 individual companies hiding inside the 8 ETF portfolio. For each company, see its sector, weighting, and presence across multiple funds.

Here’s my current top 10 by portfolio weight - these are the businesses really driving the results:

MSFT (Microsoft): Tech powerhouse and dividend giant.

AAPL (Apple): World-class tech and cash flow machine.

NVDA (Nvidia): Accelerating growth in AI and data.

CVX (Chevron): Stable energy dividends.

JPM (JPMorgan Chase): Financial sector leader.

META (Meta Platforms): Growth and profits in digital media.

RTX (RTX Corporation): Major player in aerospace and defense.

ABBV (AbbVie): Healthcare strength and growth.

V (Visa): Payment tollbooth with global reach.

KO (Coca-Cola): Iconic consumer staple with reliable dividends.

Curious about the rest? The app shows all 35, giving you new research and tracking ideas!

Sector Allocation: Know Your Diversification

See exactly how the portfolio is split among sectors like Technology, Consumer Staples, Financial Services, and Real Estate. This helps me balance growth, stability, and opportunity - without overexposure to any one area.

At the top right now:

Technology (9.1%)

Consumer Staples (4.6%)

Financial Services (4.3%)

Real Estate (3.9%)

Individual Holdings: Meet the ETFs

The entire portfolio is based around 8 funds proving how simple the strategy really is. See how many shares I hold, dividend yield, expense ratio, and more.

SCHD (Schwab US Dividend Equity): The “steady Eddie,” focusing on high-quality, high-yielding U.S. dividend stocks at a low expense ratio.

CGDV (Capital Group Dividend Value): Fast-growing dividends and a unique strategy with active management from professional analysts.

FDVV (Fidelity High Dividend): A blend of yield and growth, bringing in established leaders, with a tilt toward tech.

SPYD (SPDR Portfolio S&P 500 High Dividend): Loads up on S&P stocks with the highest current yields.

DIVO (Amplify CWP Enhanced Dividend Income): Combines growing dividends with covered call premiums—an “income accelerator.”

RDVI (FT Vest Rising Dividend Achievers): Prioritizes companies growing dividends year after year with a cover call overlay.

KNG (S&P 500 Dividend Aristocrats): Only stocks that have raised dividends for 25+ straight years creating dependable income.

RLTY (Cohen & Steers Real Estate Opportunities): A real estate play to diversify and boost yield with stability.

Each ETF brings unique strengths - together, they power my “one-two punch” strategy combining dividend growth ETFs (for long-term compounding) and covered call funds (for income boosts).

Whats Next for the APP?

In the coming weeks, I’ll be diving more into the 8 ETFs and top holdings. I think it’s going to be a fun journey!

Maybe this is the dreamer in me, but I’d love to know: Would an app like Wealth Walk help you build wealth and reach financial freedom? Drop me a comment or message! Maybe one day we can bring it to life.

Thanks for walking with me - remember, every step counts!

Jeremy ✌️

Disclaimer

This article is for informational and entertainment purposes only. I am not a financial advisor, broker, or tax professional. The information provided reflects my personal opinions and experiences as an individual investor and may not be accurate or current. All investment strategies and investments involve risk of loss. Any ideas presented may not be suitable for all investors and may not take into account your specific investment objectives, financial situation, or needs. Past performance is not indicative of future results. Always conduct your own due diligence and consult with qualified financial professionals before making any investment decisions.