A Minimalist Guide to Wealth

Owning America’s top companies with one simple investment.

Day 671 | Portfolio $66,731

I just wrapped up a sunny week at the beach with my fam 🏖️.

During the trip, I took advantage of the downtime to get my niece and nephew started on their investing journey. This is what I wished someone would have shown me when I was their age.

It’s the simplest way to invest and perfect for beginners and minimalist alike. Actually, as you’ll see here in a few seconds, it’s how 90% of the population should be investing!

Let’s start with some background.

In 2016, J.L. Collins wrote The Simple Path to Wealth: Your Roadmap to Financial Independence and a Rich, Free Life. His mission was to layout an easy-to-follow financial plan for his daughter. The idea resonated with folks across the globe and sold over 1 million copies in 20 languages.

In 2025, he updated the book to include stories from those folks who took his advice to heart.

But guess what? After a decade later, the original investment strategy remains exactly the same... invest in a single fund that follows the US total stock market. AKA — own all the top companies in America!

Today, I’ll tell you why this simple investment strategy works and how easy it is to get started.

How to Beat the Pros

Investing professionals usually have 1 goal: to beat the market. Sadly, only a handful accomplish this feat, which means most people who use financial advisors are paying to underperform!

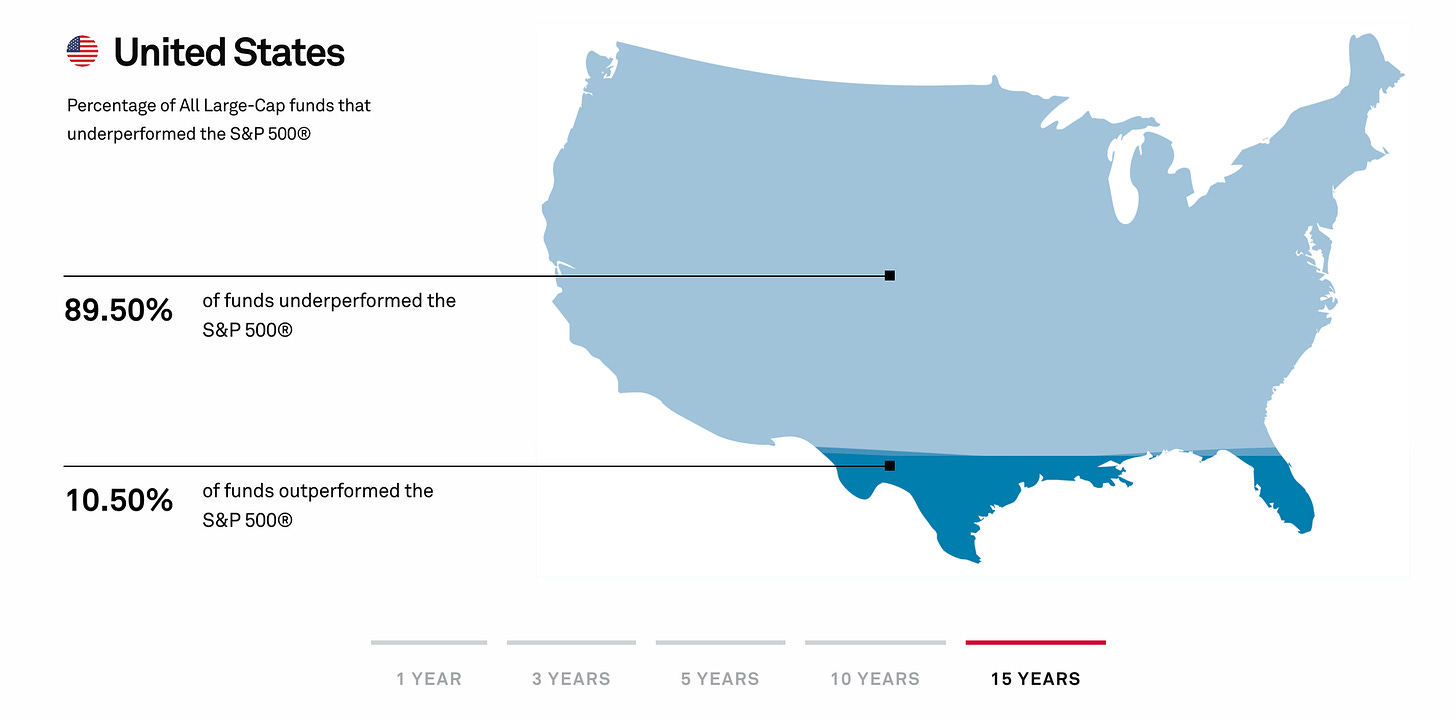

If you need some proof (like I did!) here's a quick study from the past 15 years.

Check out the full report here 👇

https://www.spglobal.com/spdji/en/research-insights/spiva/

The takeaway is surprising:

89.50% of US funds underperformed the S&P 500

The solution, as J.L. Collins wrote about, is to simply own the market that professionals strive to beat.

Meet VOO!

VOO is Vanguard‘s popular exchange traded fund (ETF) that tracks the S&P 500, which is the largest 500 companies in the US.

👆This ETF represents the “market” that all the pros try to beat.

Think of an ETF like a basket full of individual stocks. They trade on the stock market just like a normal stock, but instead of buying into 1 company you get much more for your buck. Buying 1 share of VOO makes you a co-owner of America’s top 500.

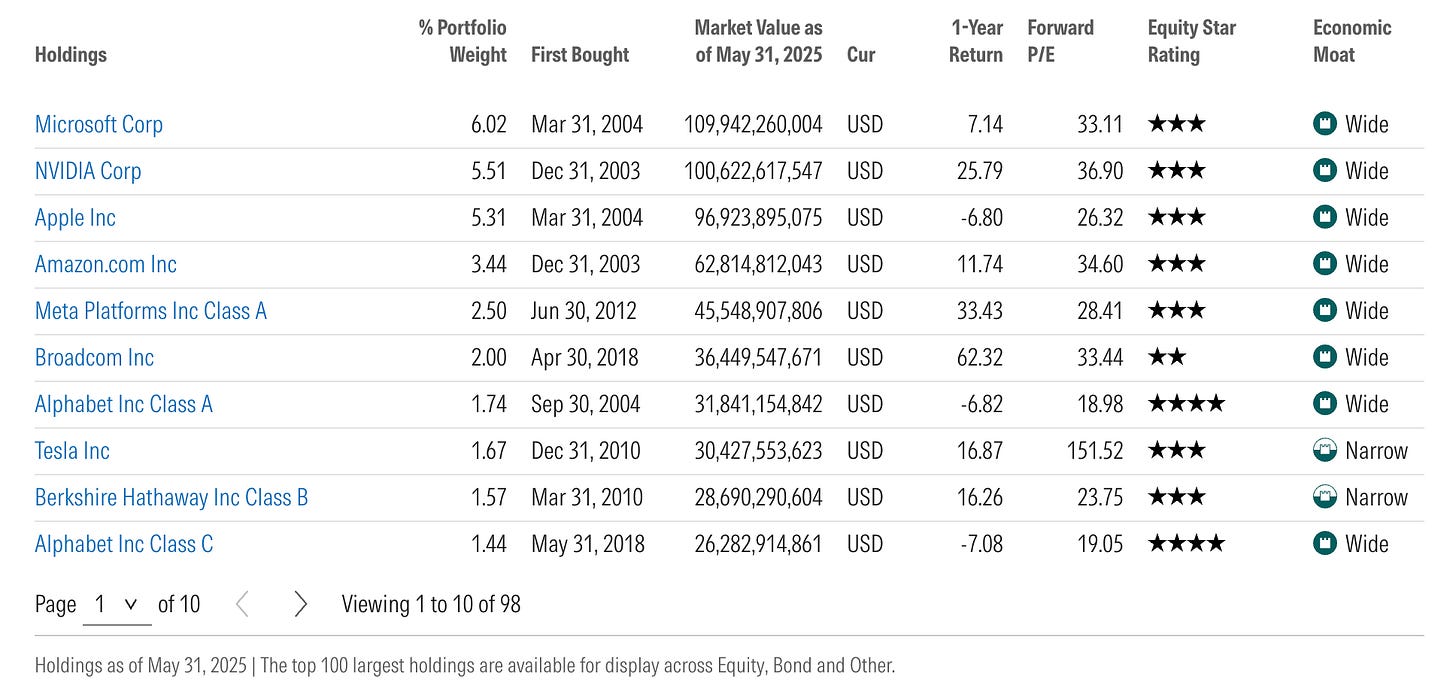

Here’s the 10 largest holdings in VOO:

Enter any big company you can think of, and it’s probably in the S&P 500.

Learn more about VOO on Vanguard’s website.

But wait, there’s more…

Meet VTI!

If 500 isn’t enough for you, you can buy VTI instead, which holds over 3,500 US companies. While the top holdings closely mirror VOO, VTI also includes small and mid-sized companies to provide a well-rounded mix.

VTI is the ETF I hooked my niece and nephew up with this week!

Here’s the 10 largest holdings:

You can learn more about the fund on Vanguard’s website.

Getting Started…

If you’re reading this and haven’t started investing yet, know you are in good company. I was recently talking to a friend who has his PhD and he said he’s never invested on his own because the whole thing scares him too much. I admit it, until you take the first step, it can be intimidating.

I like to compare investing to putting your money into a savings account.

Here’s a screenshot that I showed my niece and nephew to help explain it.

In scenario 1 (dashed line): you put $500 a month into savings. You’d have $180,000 after 30 years.

In scenario 2 (solid line): you invested $500 a month and we assume the market will have an average 10% growth (like it has the last 30 years.) You’d have $1,036,312 after 30 years.

In other words, you’d be a millionaire. I mean, that’s pretty awesome, right?

Until next time, keep walking!

Jeremy ✌️

Disclaimer

This article is for informational and educational purposes only. I am not a financial advisor, broker, or tax professional. The information provided reflects my personal opinions and experiences as an individual investor and may not be accurate or current. All investment strategies and investments involve risk of loss. Any ideas presented may not be suitable for all investors and may not take into account your specific investment objectives, financial situation, or needs. Past performance is not indicative of future results. Always conduct your own due diligence and consult with qualified financial professionals before making any investment decisions.